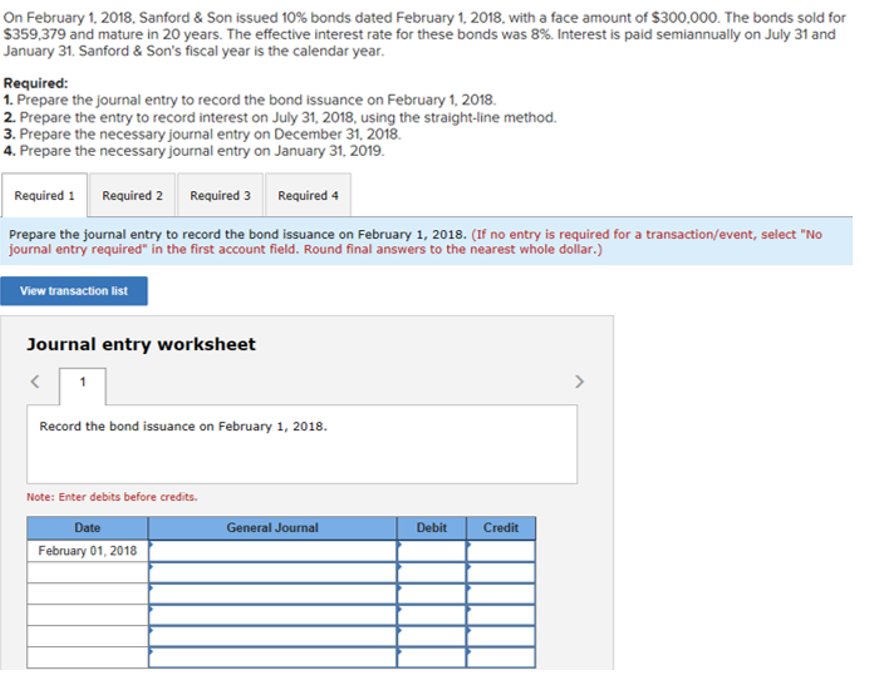

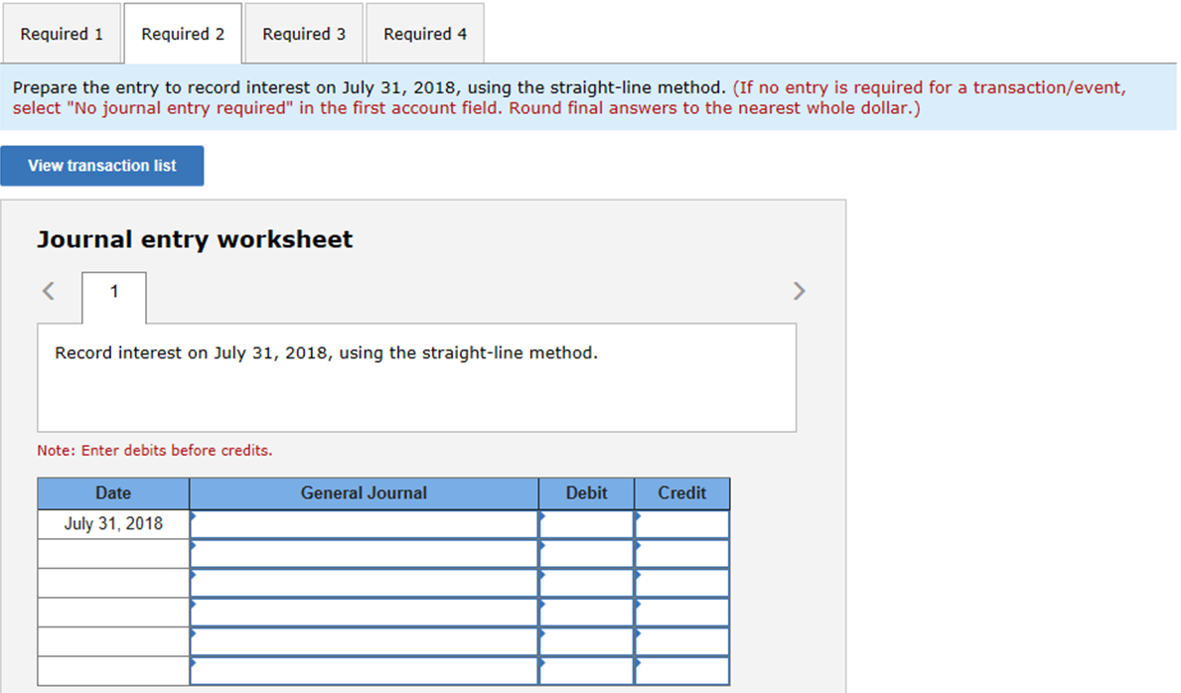

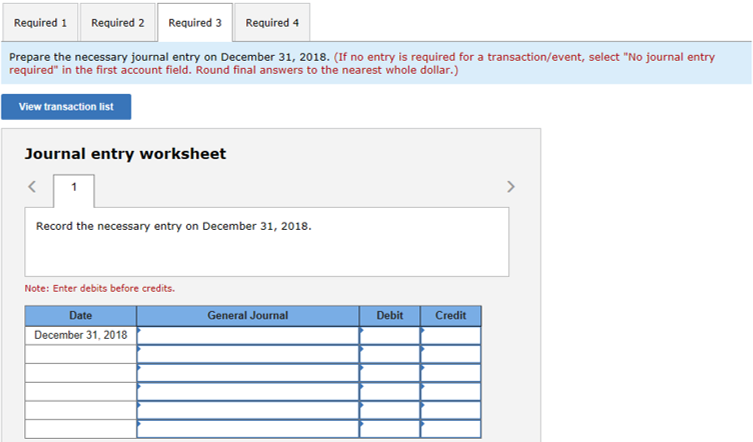

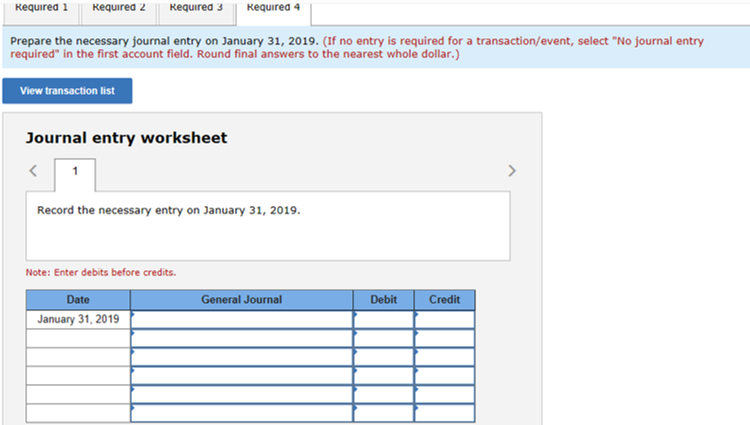

On February 1, 2018. Sanford & Son issued 10% bonds dated February 1, 2018, with a face amount of $300.000. The bonds sold for $359,379 and mature in 20 years. The effective interest rate for these bonds was 8%. Interest is paid semiannually on July 31 and January 31. Sanford & Son's fiscal year is the calendar year. Required: 1. Prepare the journal entry to record the bond issuance on February 1, 2018 2. Prepare the entry to record interest on July 31, 2018, using the straight-line method. 3. Prepare the necessary journal entry on December 31, 2018 4. Prepare the necessary journal entry on January 31, 2019 Required 1 Required 2 Required 3 Required 4 Prepare the journal entry to record the bond issuance on February 1, 2018. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round final answers to the nearest whole dollar.) View transaction list Journal entry worksheet Record the bond issuance on February 1, 2018. Note: Enter debits before credits. General Journal Debit Credit Date February 01, 2018 Required 1 Required 2 Required 3 Required 4 Prepare the entry to record interest on July 31, 2018, using the straight-line method. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round final answers to the nearest whole dollar.) View transaction list Journal entry worksheet Record interest on July 31, 2018, using the straight-line method. Note: Enter debits before credits. General Journal Debit Credit Date July 31, 2018 Required 1 Required 2 Required 3 Required 4 Prepare the necessary journal entry on December 31, 2018. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round final answers to the nearest whole dollar.) View transaction list Journal entry worksheet Record the necessary entry on December 31, 2018. Note: Enter debits before credits. General Journal Debit Credit Date December 31, 2018 Required 1 Required 2 Required 3 Required 4 Prepare the necessary journal entry on January 31, 2019. (If no entry is required for a transaction/event, select "No journal entry required in the first account field. Round final answers to the nearest whole dollar.) View transaction list Journal entry worksheet Record the necessary entry on January 31, 2019. Note: Enter debits before credits. Date General Journal Debit Credit January 31, 2019