Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On February 1, Woodpecker Company purchased inventory on account with a cost of $20,000. The credit terms were 3/10, net 30. On February 2,

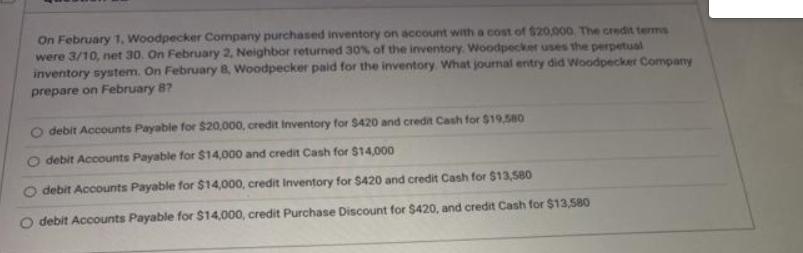

On February 1, Woodpecker Company purchased inventory on account with a cost of $20,000. The credit terms were 3/10, net 30. On February 2, Neighbor returned 30% of the inventory. Woodpecker uses the perpetual inventory system. On February B, Woodpecker paid for the inventory. What journal entry did Woodpecker Company prepare on February 8? debit Accounts Payable for S20,000, credit Inventory for $420 and credit Cash for $19,580 debit Accounts Payable for $14,000 and credit Cash for S14,000 debit Accounts Payable for $14,000, credit Inventory for S420 and credit Cash for $13,580 O debit Accounts Payable for $14,000, credit Purchase Discount for $420, and credit Cash for $13,580 Mackerel Company sells equipment for $125,000 cash. The equipment has a historical cost of $400,000 and accumulated depreciation of $265,000. The journal entry to record the sale of the equipment includes: a debit to Loss on Sale of Equipment for $10,000 O a credit to Accumulated Depreciation-Equipment of 265,000 O a credit to Gain on Sale of Equipment for $10,000 O a debit to Equipment of 400,000

Step by Step Solution

★★★★★

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started