Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On February 20, 2020 he purchased an office On April 8, 2020 he Brown operates a business. building to be used in his business

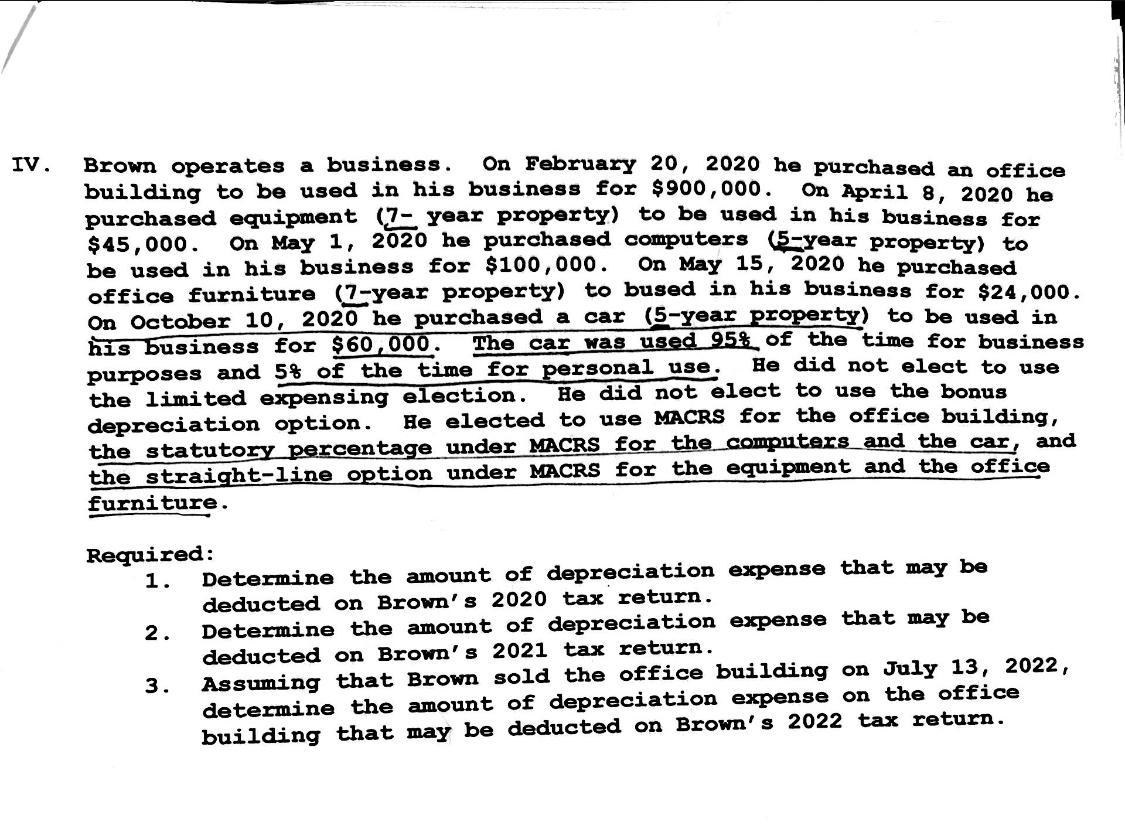

On February 20, 2020 he purchased an office On April 8, 2020 he Brown operates a business. building to be used in his business for $900,000. purchased equipment (7- year property) to be used in his business for $45,000. be used in his business for $100,000. office furniture (7-year property) to bused in his business for $24,000. On October 10, 2020 he purchased a car (5-year property) to be used in his business for $60,000. purposes and 5% of the time for personal use. the limited expensing election. depreciation option. the statutory percentage under MACRS for the computers and the car, and the straight-line option under MACRS for the equipment and the office furniture. IV. On May 1, 2020 he purchased computers (5-year property) to On May 15, 2020 he purchased The car was used 95% of the time for business He did not elect to use He did not elect to use the bonus He elected to use MACRS for the office building, Required: Determine the amount of depreciation expense that may be deducted on Brown's 2020 tax return. 1. 2. Determine the amount of depreciation expense that may be deducted on Brown's 2021 tax return. Assuming that Brown sold the office building on July 13, 2022, determine the amount of depreciation expense on the office building that may be deducted on Brown's 2022 tax return. 3.

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Office Particulars Office Building Equipment Computers Furniture Car Purchase d...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started