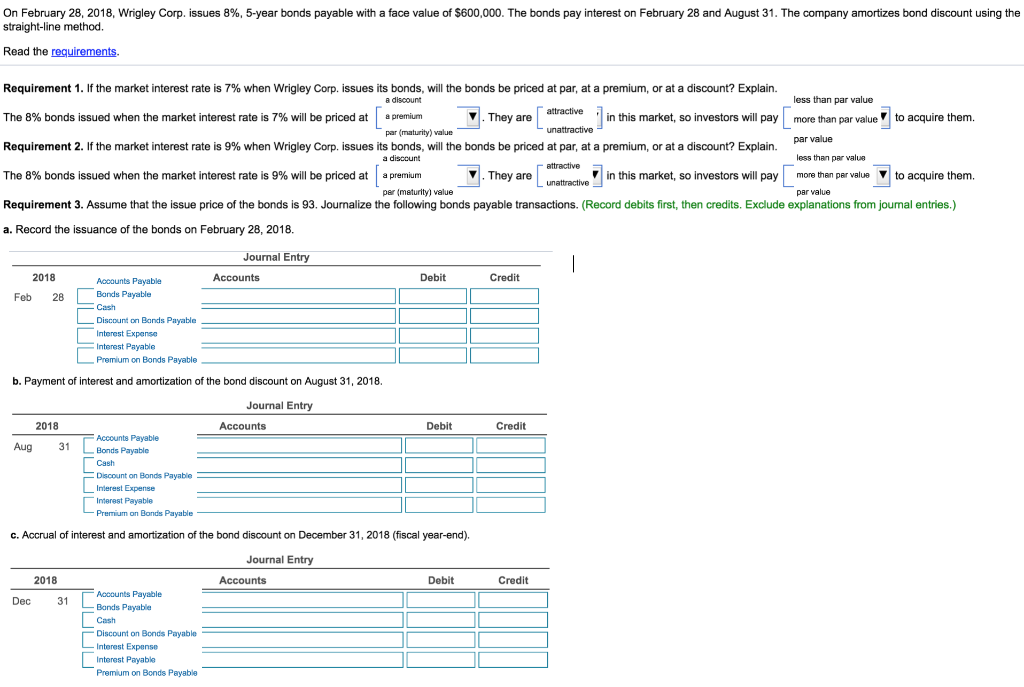

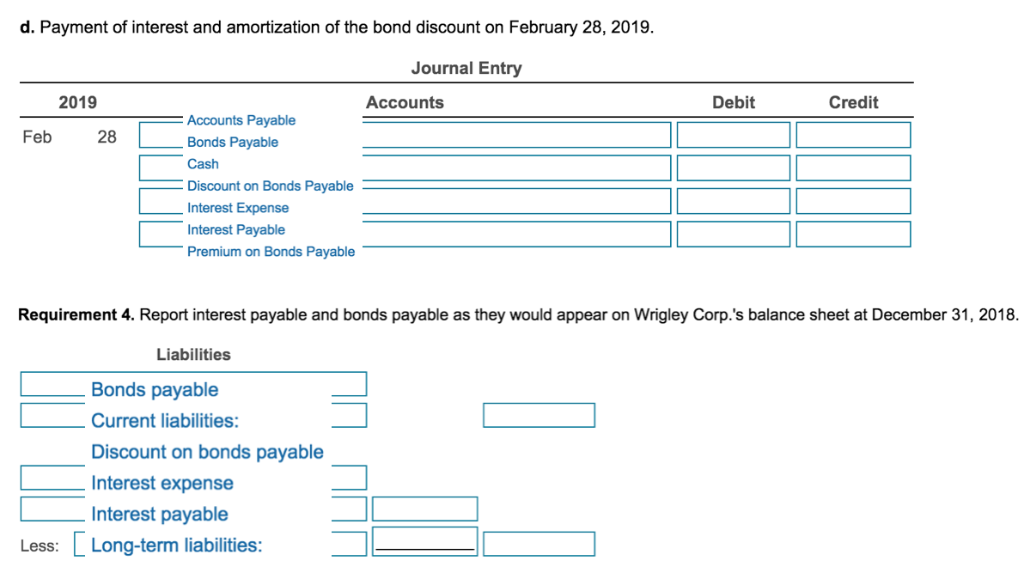

On February 28, 2018, Wrigley Corp. issues 8%, 5-year bonds payable with a face value of $600,000. The bonds pay interest on February 28 and August 31, The company amortizes bond discount using the straight-line method. Read the requirements. Requirement 1 . If the market interest rate is 7% when Wrigley Corp. issues its bonds, will the bonds be priced at par, at a premium, or at a discount? Explain. The 8% bonds issued when the market interest rate is 7% will be priced at | a premium Requirement 2. If the market interest rate is 9% when Wrigley Corp. issues its bonds, will the bonds be priced at par, at a premium, or at a discount? Explain. The 8% bonds issued when the market interest rate is 9% will be priced at a premium Requirement 3. Assume that the issue price of the bonds is 93. Journalize the following bonds payable transactions. (Record debits first, then credits. Exclude explanations from journal entries.) a. Record the issuance of the bonds on February 28, 2018 less than par value a discount attractive i . They are in this market, so investors will pay more than par valueto acquire them. unattractive par (maturity) value par value less than par value more then per value par value a disccunt '| in this market, so investors will pay to acquire them. per (meturity) value Journal Entry Credit 2018 Accounts Debit Accounts Payable Bonds Payable Cash Discount on Bands Payable Interest Expense Interest Payable Premium on Bonds Payable Feb 28 b. Payment of interest and amortization of the bond discount on August 31, 2018 Journal Entry 2018 Accounts Debit Credit Accounts Payable onds Payable Aug 31 Cash Discount on Bonds Payable Interest Expense Imerest Payable Premium on Bonds Payable c. Accrual of interest and amortization of the bond discount on December 31, 2018 (fiscal year-end) Journal Entry 2018 Debit Credit Accounts Payable Bonds Payable Cash Discount on Bonds Payable Interest Expense Interest Payable Premium on Bonds Payable Dec 31 d. Payment of interest and amortization of the bond discount on February 28, 2019. Journal Entry 2019 Accounts Debit Credit Accounts Payable Bonds Payable Cash Discount on Bonds Payable Feb 28 Interest Expense Interest Payable Premium on Bonds Payable Requirement 4. Report interest payable and bonds payable as they would appear on Wrigley Corp.s balance sheet at December 31, 2018. Liabilities Bonds payable Current liabilities: Discount on bonds payable Interest expense Interest payable Less: LLong-term liabilities