Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On February 4, 2018, Jackie purchased and placed in service a car she purchased for $21,000. The car was used exclusively for her business. Compute

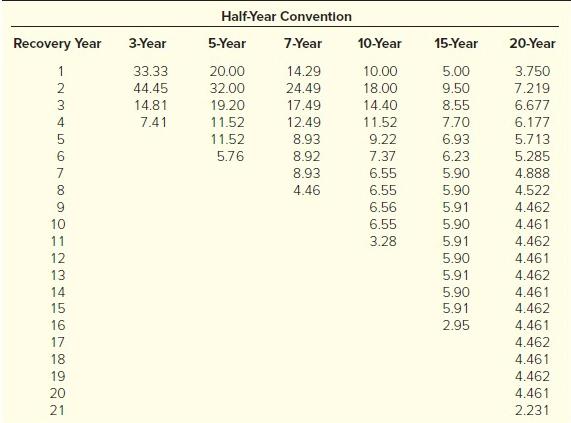

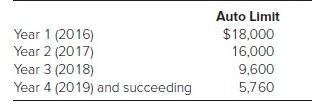

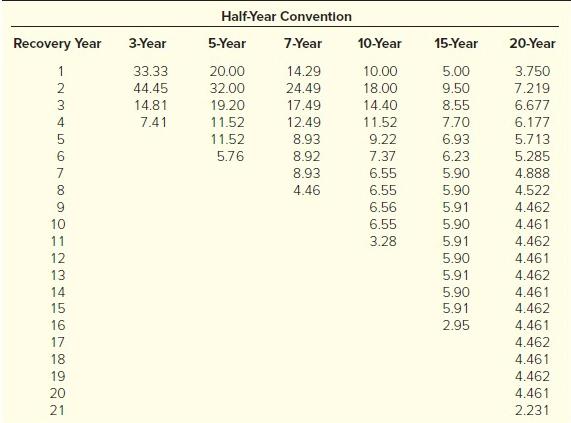

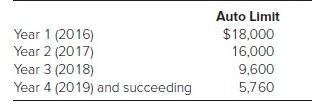

On February 4, 2018, Jackie purchased and placed in service a car she purchased for $21,000. The car was used exclusively for her business. Compute Jackie’s cost recovery deduction in 2018 assuming no §179 expense but the bonus was taken: (Use Table 6A-1 and Luxury Automobile Depreciation)

Half-Year Convention Recovery Year 3-Year 5-Year 7-Year 10-Year 15-Year 20-Year 1 33.33 20.00 14.29 10.00 5.00 3.750 2 44.45 32.00 24.49 17.49 18.00 9.50 7.219 3 14.81 19.20 14.40 11.52 8.55 6.677 4 7.41 11.52 12.49 7.70 6.177 11.52 8.93 9.22 6.93 5.713 5.76 8.92 7.37 6.23 5.90 5.285 7 8.93 6.55 4.888 8. 4.46 6.55 5.90 4.522 9 6.56 5.91 4.462 10 6.55 5.90 4.461 11 3.28 5.91 4.462 12 5.90 5.91 4.461 13 4.462 14 5.90 4.461 15 5.91 4.462 16 2.95 4.461 17 4.462 18 4.461 19 4.462 20 4.461 21 2.231

Step by Step Solution

★★★★★

3.47 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

The answer is 18000 W...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

636478aebcf58_239309.pdf

180 KBs PDF File

636478aebcf58_239309.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started