Answered step by step

Verified Expert Solution

Question

1 Approved Answer

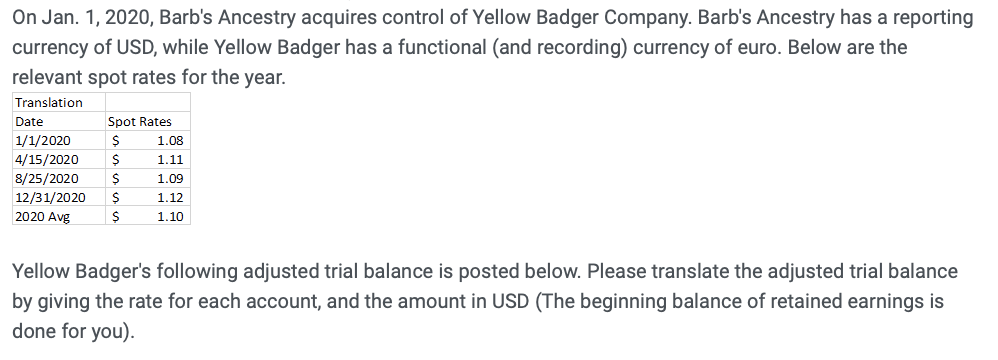

On Jan. 1, 2020, Barb's Ancestry acquires control of Yellow Badger Company. Barb's Ancestry has a reporting currency of USD, while Yellow Badger has

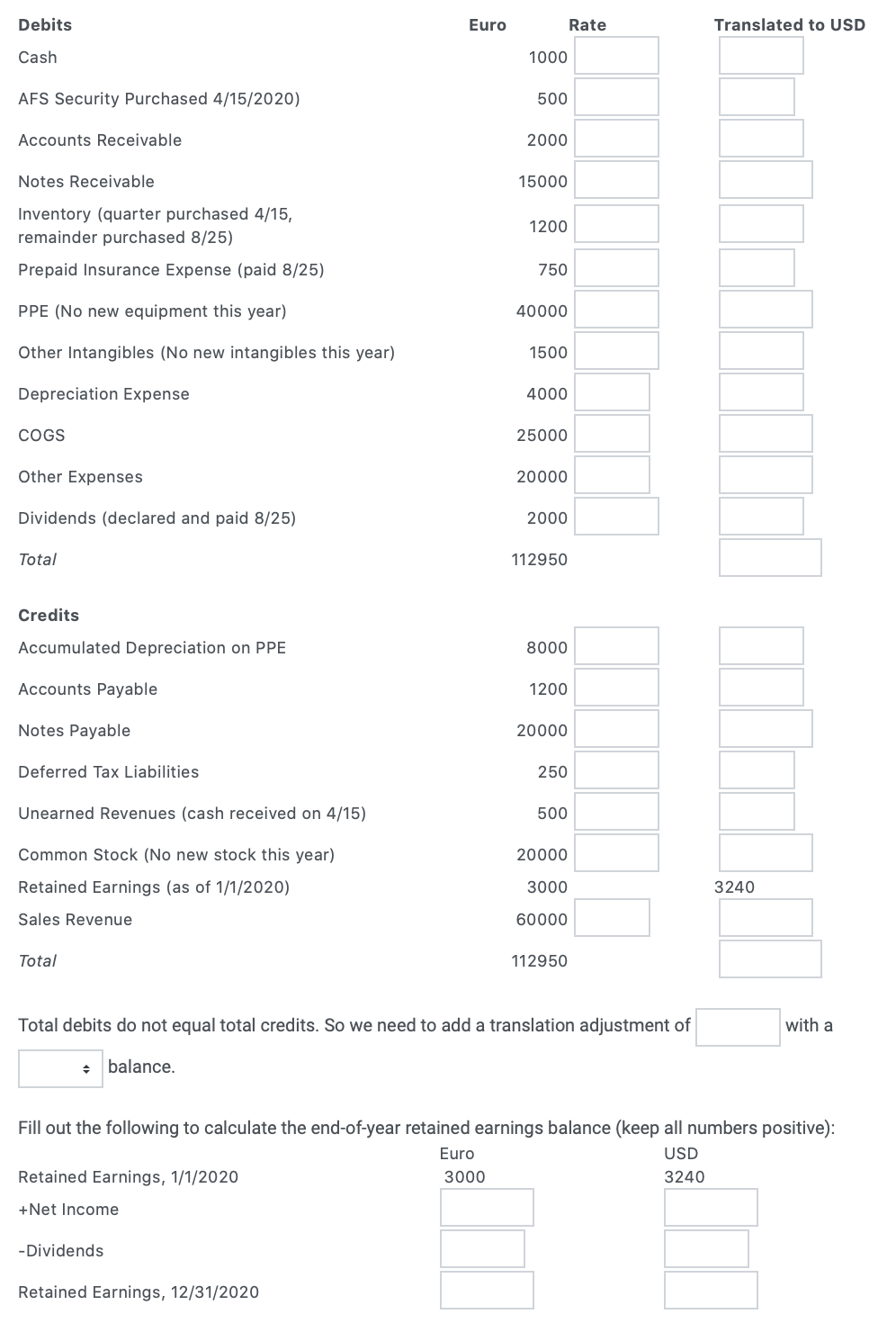

On Jan. 1, 2020, Barb's Ancestry acquires control of Yellow Badger Company. Barb's Ancestry has a reporting currency of USD, while Yellow Badger has a functional (and recording) currency of euro. Below are the relevant spot rates for the year. Translation Date Spot Rates 1/1/2020 $ 1.08 4/15/2020 S 1.11 8/25/2020 S 1.09 12/31/2020 $ 1.12 2020 Avg $ 1.10 Yellow Badger's following adjusted trial balance is posted below. Please translate the adjusted trial balance by giving the rate for each account, and the amount in USD (The beginning balance of retained earnings is done for you). Euro Debits Cash 1000 AFS Security Purchased 4/15/2020) 500 Accounts Receivable 2000 Notes Receivable 15000 Inventory (quarter purchased 4/15, remainder purchased 8/25) 1200 Prepaid Insurance Expense (paid 8/25) 750 PPE (No new equipment this year) 40000 Other Intangibles (No new intangibles this year) 1500 Depreciation Expense 4000 COGS 25000 Other Expenses 20000 Dividends (declared and paid 8/25) 2000 Total 112950 Credits Accumulated Depreciation on PPE 8000 Accounts Payable 1200 Notes Payable 20000 Deferred Tax Liabilities 250 Unearned Revenues (cash received on 4/15) 500 Common Stock (No new stock this year) 20000 Retained Earnings (as of 1/1/2020) 3000 3240 Sales Revenue 60000 Total 112950 Total debits do not equal total credits. So we need to add a translation adjustment of with a balance. Fill out the following to calculate the end-of-year retained earnings balance (keep all numbers positive): Euro USD Retained Earnings, 1/1/2020 3240 +Net Income -Dividends Retained Earnings, 12/31/2020 3000 Rate Translated to USD

Step by Step Solution

There are 3 Steps involved in it

Step: 1

DEBITS EURO RATE TRANSLATED TO EURO CASH 1000 112 1120 AFS SECURITY PURCHASED 500 111 555 ACCOUNTS R...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started