Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On Jan. 1, 2020, the Francis Co. provided the following information in relation to a defined benefit plan: Fair value of plan assets Projected

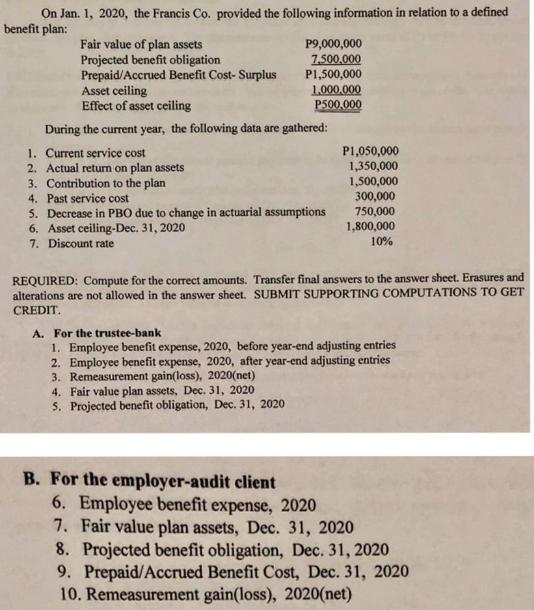

On Jan. 1, 2020, the Francis Co. provided the following information in relation to a defined benefit plan: Fair value of plan assets Projected benefit obligation Prepaid/Accrued Benefit Cost- Surplus P9,000,000 7,500,000 P1,500,000 1,000,000 P500,000 Asset ceiling Effect of asset ceiling During the current year, the following data are gathered: 1. Current service cost 2. Actual return on plan assets 3. Contribution to the plan 4. Past service cost 5. Decrease in PBO due to change in actuarial assumptions 6. Asset ceiling-Dec. 31, 2020 7. Discount rate P1,050,000 1,350,000 1,500,000 300,000 750,000 1,800,000 10% REQUIRED: Compute for the correct amounts. Transfer final answers to the answer sheet. Erasures and alterations are not allowed in the answer sheet. SUBMIT SUPPORTING COMPUTATIONS TO GET CREDIT. A. For the trustee-bank 1. Employee benefit expense, 2020, before year-end adjusting entries 2. Employee benefit expense, 2020, after year-end adjusting entries 3. Remeasurement gain(loss), 2020(net) 4. Fair value plan assets, Dec. 31, 2020 5. Projected benefit obligation, Dec. 31, 2020- B. For the employer-audit client 6. Employee benefit expense, 2020 7. Fair value plan assets, Dec. 31, 2020 8. Projected benefit obligation, Dec. 31, 2020 9. Prepaid/Accrued Benefit Cost, Dec. 31, 2020 10. Remeasurement gain(loss), 2020(net)

Step by Step Solution

★★★★★

3.50 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

A For the trusteebank Employee Benefit Expense 2020 before yearend adjusting entries Current Service ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started