Answered step by step

Verified Expert Solution

Question

1 Approved Answer

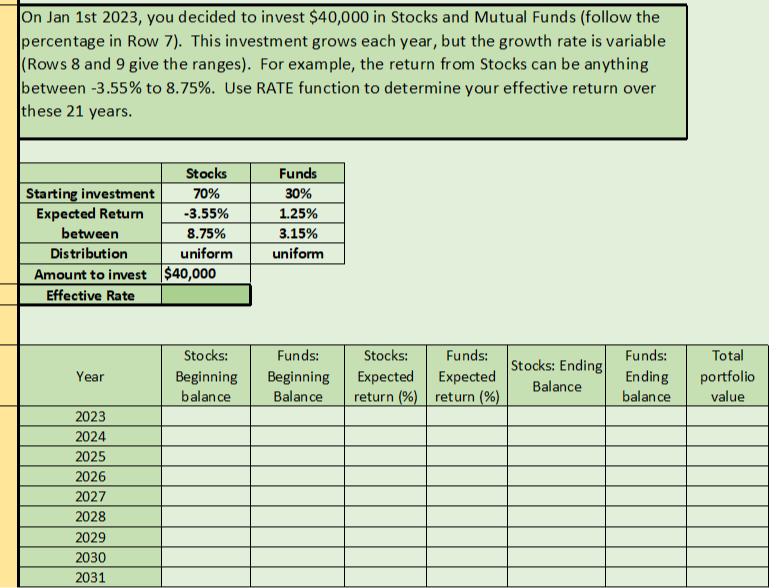

On Jan 1st 2023, you decided to invest $40,000 in Stocks and Mutual Funds (follow the percentage in Row 7). This investment grows each

On Jan 1st 2023, you decided to invest $40,000 in Stocks and Mutual Funds (follow the percentage in Row 7). This investment grows each year, but the growth rate is variable (Rows 8 and 9 give the ranges). For example, the return from Stocks can be anything between -3.55% to 8.75%. Use RATE function to determine your effective return over these 21 years. Starting investment Expected Return between Distribution Amount to invest Effective Rate Year 2023 2024 2025 2026 2027 2028 2029 2030 2031 Stocks 70% -3.55% 8.75% uniform $40,000 Funds 30% 1.25% 3.15% uniform Stocks: Funds: Beginning Beginning balance Balance Stocks: Expected return (%) Funds: Expected return (%) Stocks: Ending Balance Funds: Ending balance Total portfolio value

Step by Step Solution

★★★★★

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

The image presents a spreadsheet layout with an investment scenario In this scenario an individual decided to invest 40000 on January 1 2023 into stoc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started