Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 1978, the purchasing engineer of a Cement Co. purchased a new machine at a cost of P140,000.00. Depreciation has been computed

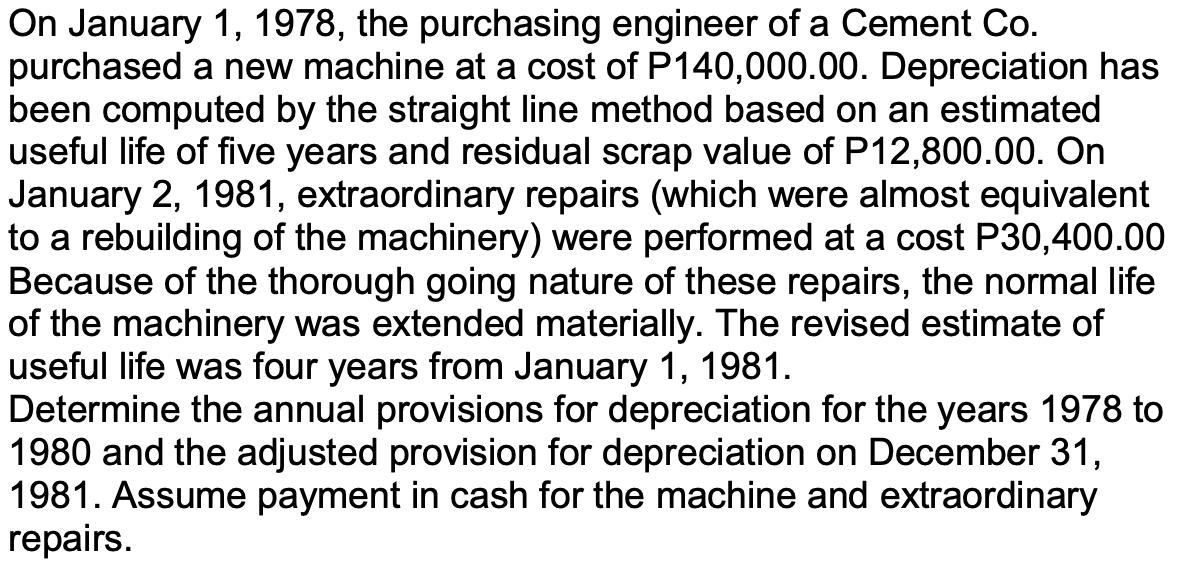

On January 1, 1978, the purchasing engineer of a Cement Co. purchased a new machine at a cost of P140,000.00. Depreciation has been computed by the straight line method based on an estimated useful life of five years and residual scrap value of P12,800.00. On January 2, 1981, extraordinary repairs (which were almost equivalent to a rebuilding of the machinery) were performed at a cost P30,400.00 Because of the thorough going nature of these repairs, the normal life of the machinery was extended materially. The revised estimate of useful life was four years from January 1, 1981. Determine the annual provisions for depreciation for the years 1978 to 1980 and the adjusted provision for depreciation on December 31, 1981. Assume payment in cash for the machine and extraordinary repairs.

Step by Step Solution

★★★★★

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Depreciation is the allocation of cost of asset over the useful life of the asset Under s...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started