Answered step by step

Verified Expert Solution

Question

1 Approved Answer

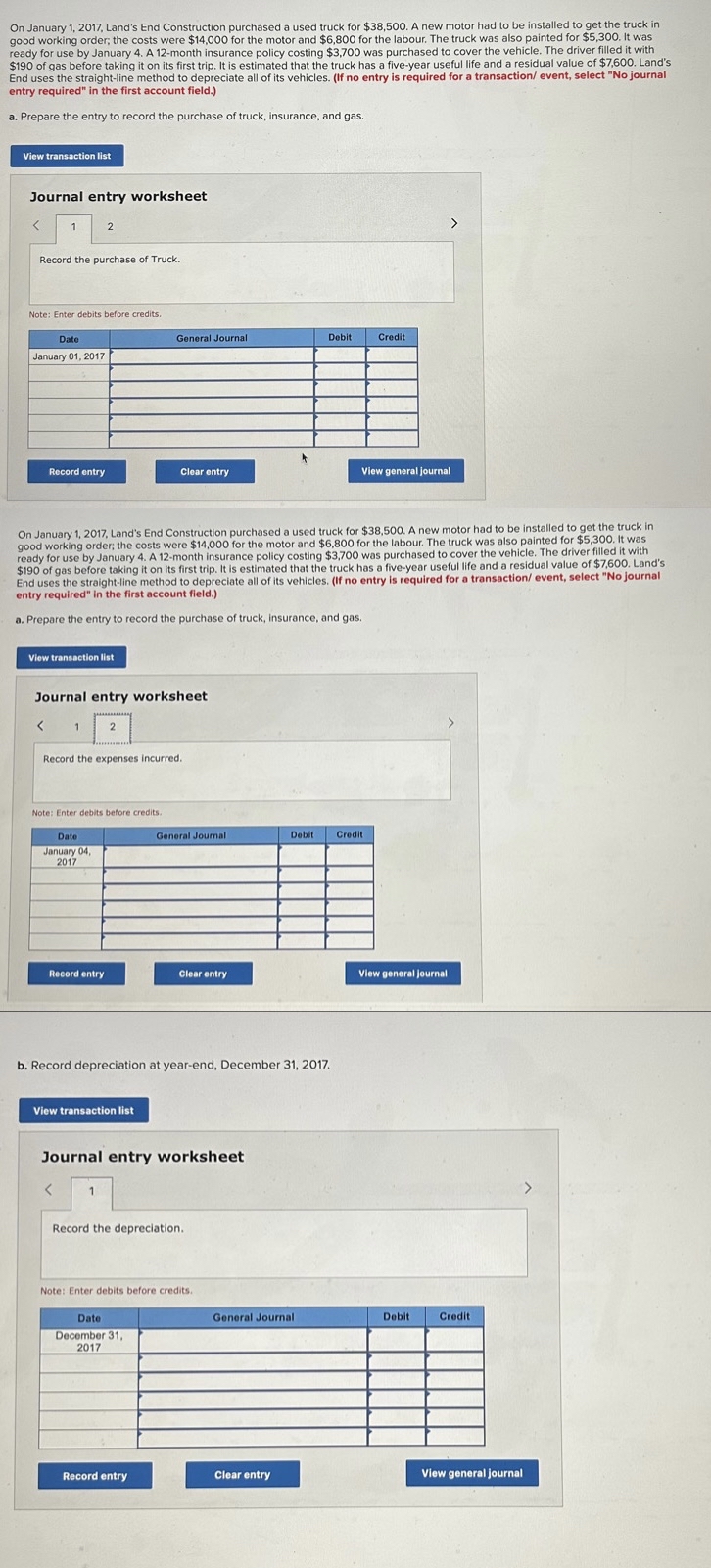

On January 1 , 2 0 1 7 , Land's End Construction purchased a used truck for $ 3 8 , 5 0 0 .

On January Land's End Construction purchased a used truck for $ A new motor had to be installed to get the truck in good working order, the costs were $ for the motor and $ for the labour. The truck was also painted for $ It was ready for use by January A month insurance policy costing $ was purchased to cover the vehicle. The driver filled it with $ of gas before taking it on its first trip. It is estimated that the truck has a fiveyear useful life and a residual value of $ Land's End uses the straightline method to depreciate all of its vehicles. If no entry is required for a transaction event, select No journal entry required" in the first account field.

a Prepare the entry to record the purchase of truck, insurance, and gas.

Journal entry worksheet

Record the purchase of Truck.

Note: Enter debits before credits.

tableDateGeneral Journal,Debit,CreditJanuary

On January Land's End Construction purchased a used truck for $ A new motor had to be installed to get the truck in good working order; the costs were $ for the motor and $ for the labour. The truck was also painted for $ It was End uses the straightline method to depreciate all of its vehicles. If no entry is required for a transaction event, select No journal entry required" in the first account field.

a Prepare the entry to record the purchase of truck, insurance, and gas.

Journal entry worksheet

Record the expenses incurred.

Note: Enter debits before credits.

tableDateGeneral Journal,Debit,CredittableJanuary

b Record depreciation at yearend, December

Journal entry worksheet

Record the depreciation.

Note: Enter debits before credits.

tableDateGeneral Journal,Debit,CredittableDecember

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started