Answered step by step

Verified Expert Solution

Question

1 Approved Answer

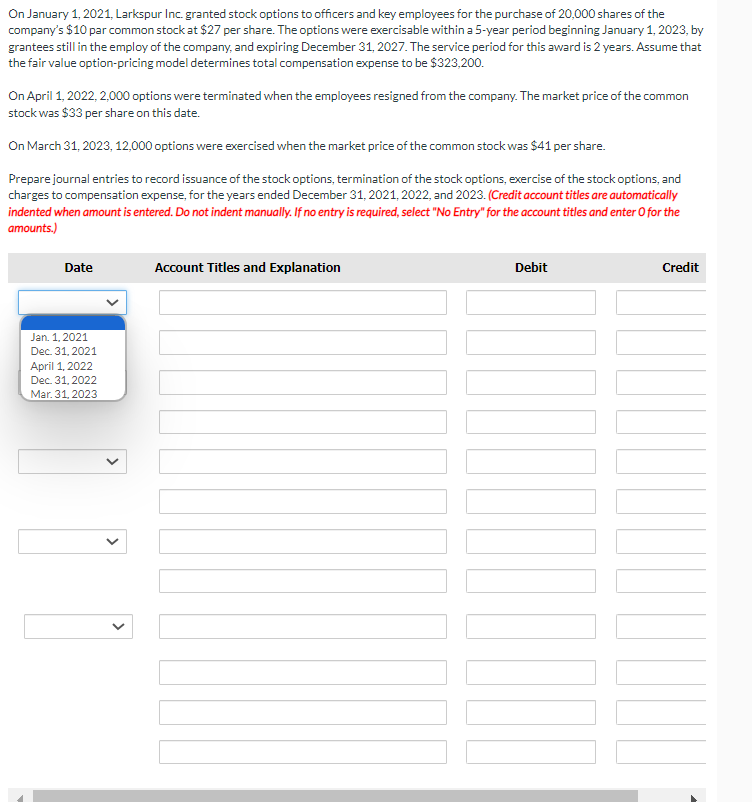

On January 1 , 2 0 2 1 , Larkspur Inc. granted stock options to officers and key employees for the purchase of 2 0

On January Larkspur Inc. granted stock options to officers and key employees for the purchase of shares of the

company's $ par common stock at $ per share. The options were exercisable within a year period beginning January by

grantees still in the employ of the company, and expiring December The service period for this award is years. Assume that

the fair value optionpricing model determines total compensation expense to be $

On April options were terminated when the employees resigned from the company. The market price of the common

stock was $ per share on this date.

On March options were exercised when the market price of the common stock was $ per share.

Prepare journal entries to record issuance of the stock options, termination of the stock options, exercise of the stock options, and

charges to compensation expense, for the years ended December and Credit account titles are automatically

indented when amount is entered. Do not indent manually. If no entry is required, select No Entry" for the account titles and enter O for the

amounts.

Date

Account Titles and Explanation

Debit

Credit

Jan.

Dec.

April

Dec.

Mar.

Here are the labels for the problem:

Bond Conversion Expanse

Bonds Payable

Cash

Compensation Expanse

Cammon Stock

Convertible Preferred Stock

Debt Conversion Expanse

Discount on Bonds Payable

Gain on Repurchase

Income Summary

Incremental Cash

Insurance Expanse

Interest Expanse

Interest Payable

Interest Receivable

Liability under Stock Appreciation Plan

No Entry

Paidin Capital in Excess of Par Common Stock

Paidin Capital in Excess of Par Preferred Stock

Paidin CapitalExpired Stock Options

Paidin CapitalStock Options

Paidin CapitalStock Warrants

Premium on Bonds Payable

Preferred Stock

Retained Earnings

Share CapitalOrdinary

Share PremiumConversion Equity

Share PremiumShare Options

Share PremiumOrdinary

Unamortized Bond Issue Costs

Unearned Compensation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started