Answered step by step

Verified Expert Solution

Question

1 Approved Answer

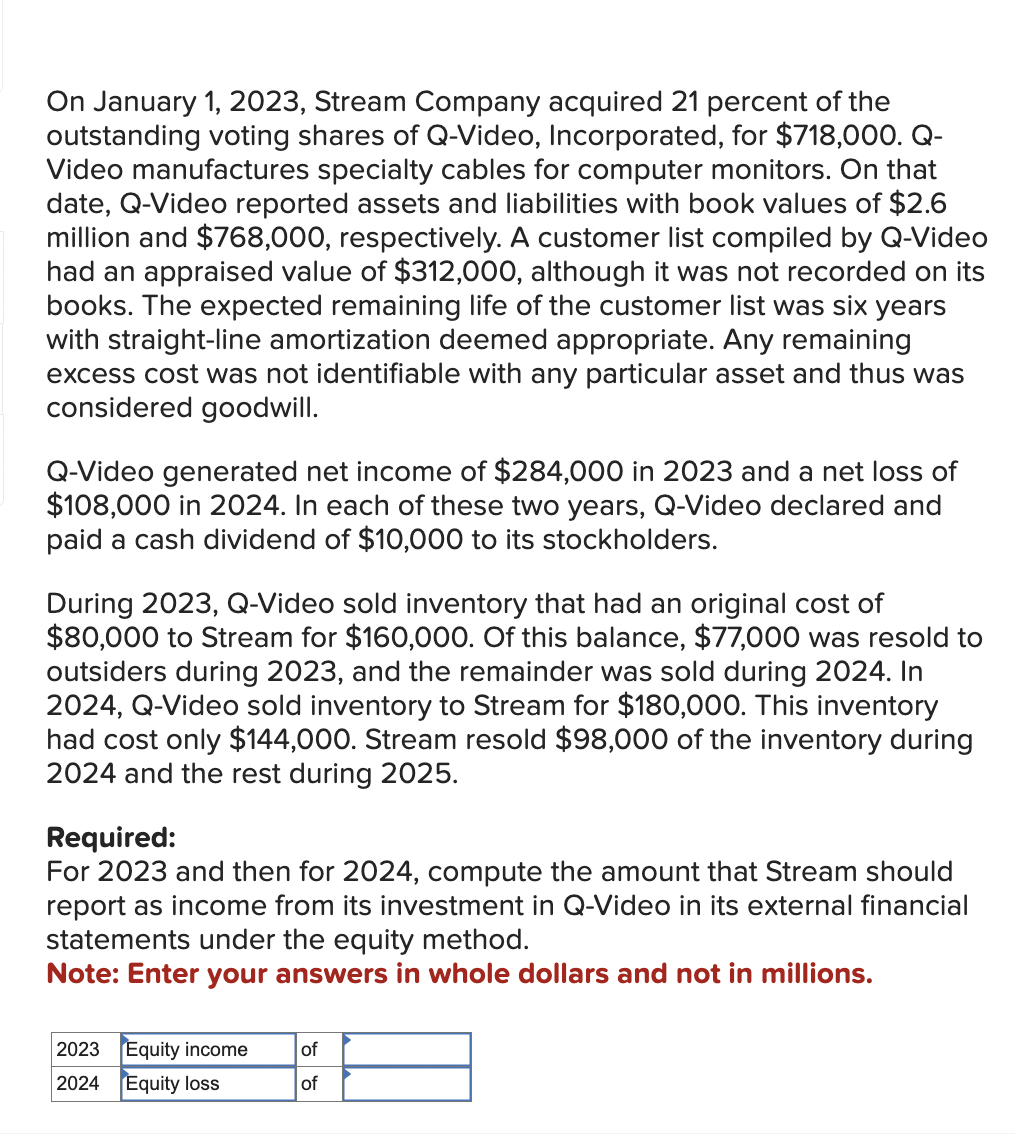

On January 1 , 2 0 2 3 , Stream Company acquired 2 1 percent of the outstanding voting shares of Q - Video, Incorporated,

On January Stream Company acquired percent of the

outstanding voting shares of QVideo, Incorporated, for $ Q

Video manufactures specialty cables for computer monitors. On that

date, QVideo reported assets and liabilities with book values of $

million and $ respectively. A customer list compiled by QVideo

had an appraised value of $ although it was not recorded on its

books. The expected remaining life of the customer list was six years

with straightline amortization deemed appropriate. Any remaining

excess cost was not identifiable with any particular asset and thus was

considered goodwill.

QVideo generated net income of $ in and a net loss of

$ in In each of these two years, QVideo declared and

paid a cash dividend of $ to its stockholders.

During QVideo sold inventory that had an original cost of

$ to Stream for $ Of this balance, $ was resold to

outsiders during and the remainder was sold during In

QVideo sold inventory to Stream for $ This inventory

had cost only $ Stream resold $ of the inventory during

and the rest during

Required:

For and then for compute the amount that Stream should

report as income from its investment in QVideo in its external financial

statements under the equity method.

Note: Enter your answers in whole dollars and not in millions.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started