Answered step by step

Verified Expert Solution

Question

1 Approved Answer

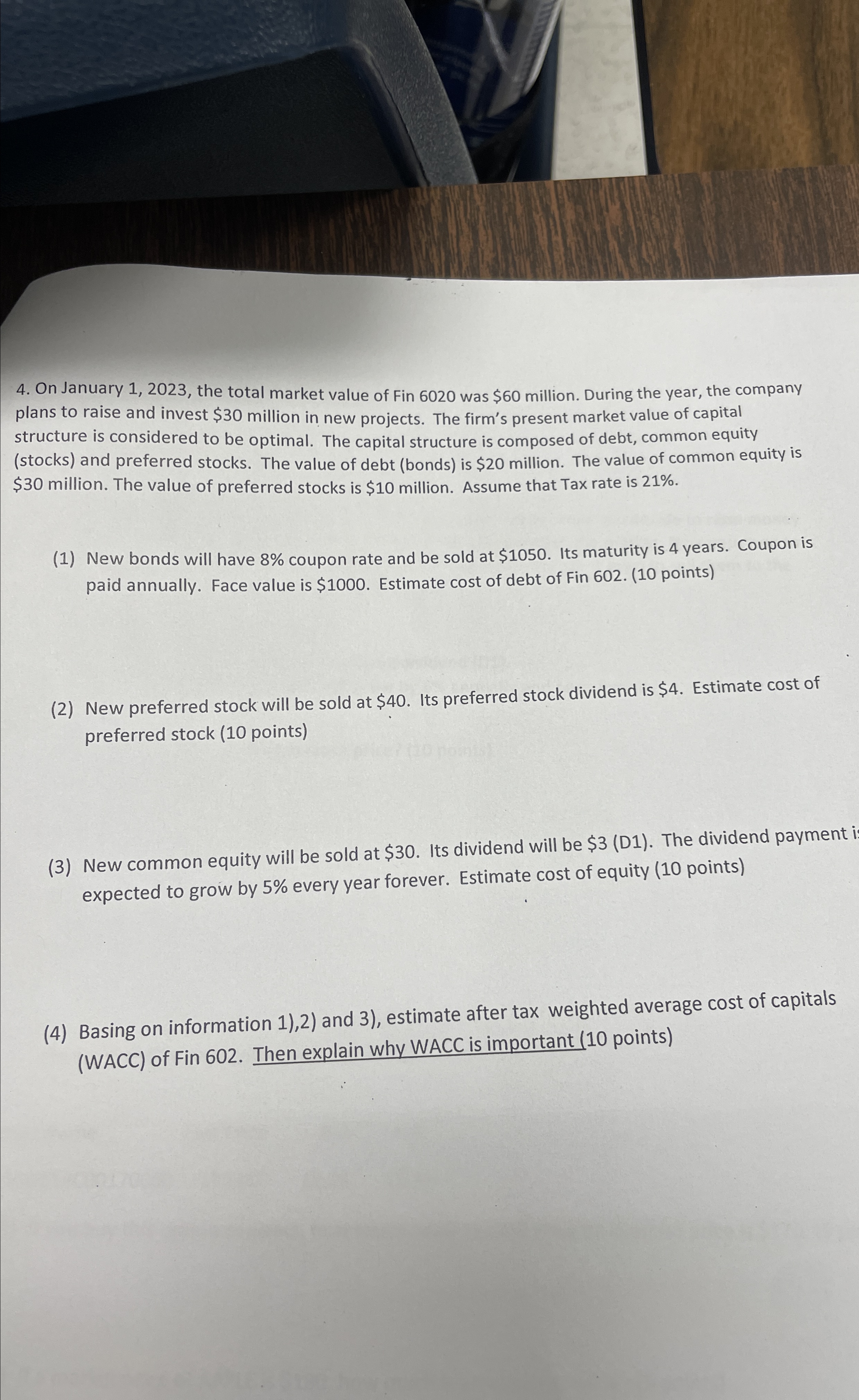

On January 1 , 2 0 2 3 , the total market value of Fin 6 0 2 0 was $ 6 0 million. During

On January the total market value of Fin was $ million. During the year, the company plans to raise and invest $ million in new projects. The firm's present market value of capital structure is considered to be optimal. The capital structure is composed of debt, common equity stocks and preferred stocks. The value of debt bonds is $ million. The value of common equity is $ million. The value of preferred stocks is $ million. Assume that Tax rate is

New bonds will have coupon rate and be sold at $ Its maturity is years. Coupon is paid annually. Face value is $ Estimate cost of debt of Fin points

New preferred stock will be sold at $ Its preferred stock dividend is $ Estimate cost of preferred stock points

New common equity will be sold at $ Its dividend will be $D The dividend payment expected to grow by every year forever. Estimate cost of equity points

Basing on information and estimate after tax weighted average cost of capitals WACC of Fin Then explain why WACC is important points

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started