Answered step by step

Verified Expert Solution

Question

1 Approved Answer

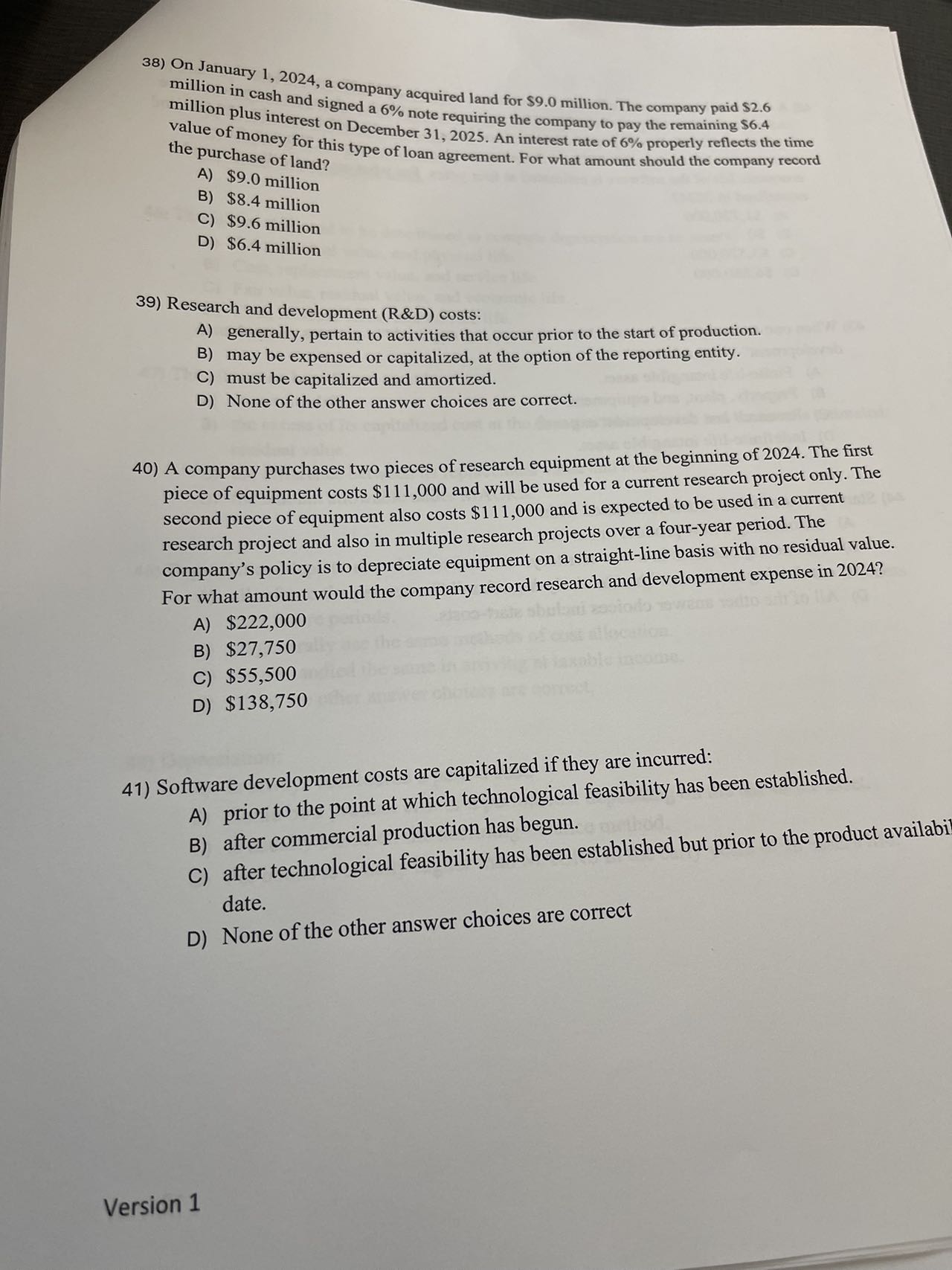

On January 1 , 2 0 2 4 , a company acquired land for $ 9 . 0 million. The company paid $ 2 .

On January a company acquired land for $ million. The company paid $

million in cash and signed a note requiring the company to pay the remaining $

million plus interest on December An interest rate of properly reflects the time

value of money for this type of loan agreement. For what amount should the company record

the purchase of land?

A $ million

B $ million

C $ million

D $ million

Research and development R&D costs:

A generally, pertain to activities that occur prior to the start of production.

B may be expensed or capitalized, at the option of the reporting entity.

C must be capitalized and amortized.

D None of the other answer choices are correct.

A company purchases two pieces of research equipment at the beginning of The first

piece of equipment costs $ and will be used for a current research project only. The

second piece of equipment also costs $ and is expected to be used in a current

research project and also in multiple research projects over a fouryear period. The

company's policy is to depreciate equipment on a straightline basis with no residual value.

For what amount would the company record research and development expense in

A $

B $

C $

D $

Software development costs are capitalized if they are incurred:

A prior to the point at which technological feasibility has been established.

B after commercial production has begun.

C after technological feasibility has been established but prior to the product availabi

date.

D None of the other answer choices are correct

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started