Answered step by step

Verified Expert Solution

Question

1 Approved Answer

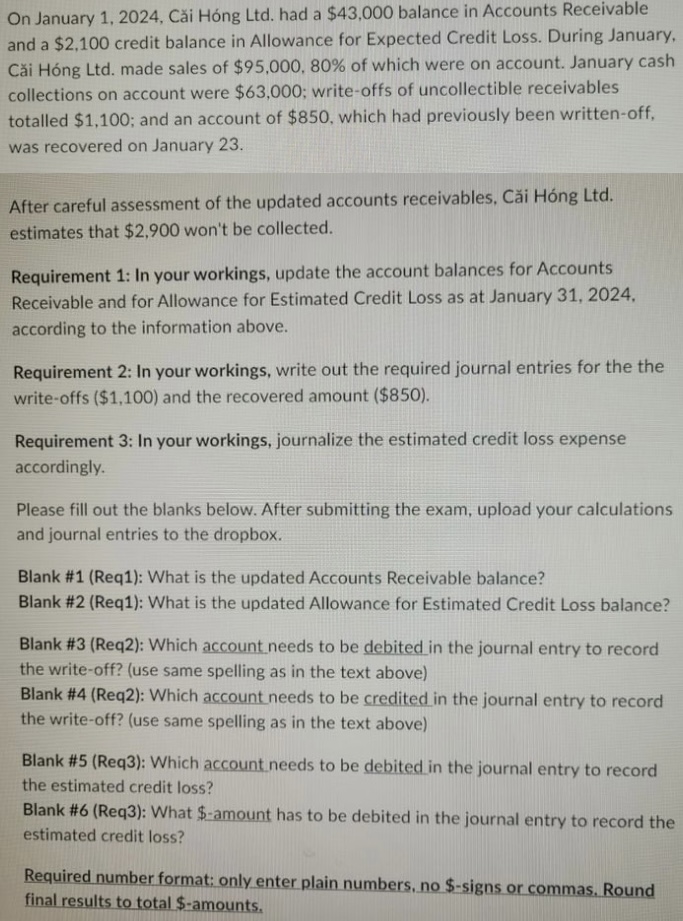

On January 1 , 2 0 2 4 , C i H ng Ltd . had a $ 4 3 , 0 0 0 balance

On January Ci Hng Ltd had a $ balance in Accounts Receivable

and a $ credit balance in Allowance for Expected Credit Loss. During January,

Ci Hng Ltd made sales of $ of which were on account. January cash

collections on account were $; writeoffs of uncollectible receivables

totalled $; and an account of $ which had previously been writtenoff,

was recovered on January

After careful assessment of the updated accounts receivables, Ci Hng Ltd

estimates that $ won't be collected.

Requirement : In your workings, update the account balances for Accounts

Receivable and for Allowance for Estimated Credit Loss as at January

according to the information above.

Requirement : In your workings, write out the required journal entries for the the

writeoffs $ and the recovered amount $

Requirement : In your workings, journalize the estimated credit loss expense

accordingly.

Please fill out the blanks below. After submitting the exam, upload your calculations

and journal entries to the dropbox.

Blank #Req: What is the updated Accounts Receivable balance?

Blank #Req: What is the updated Allowance for Estimated Credit Loss balance?

Blank #Req: Which account needs to be debited in the journal entry to record

the writeoff? use same spelling as in the text above

Blank #Req: Which account needs to be credited in the journal entry to record

the writeoff? use same spelling as in the text above

Blank #Req: Which account needs to be debited in the journal entry to record

the estimated credit loss?

Blank #Req: What $amount has to be debited in the journal entry to record the

estimated credit loss?

Required number format: only enter plain numbers, no $signs or commas. Round

final results to total $amounts.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started