Answered step by step

Verified Expert Solution

Question

1 Approved Answer

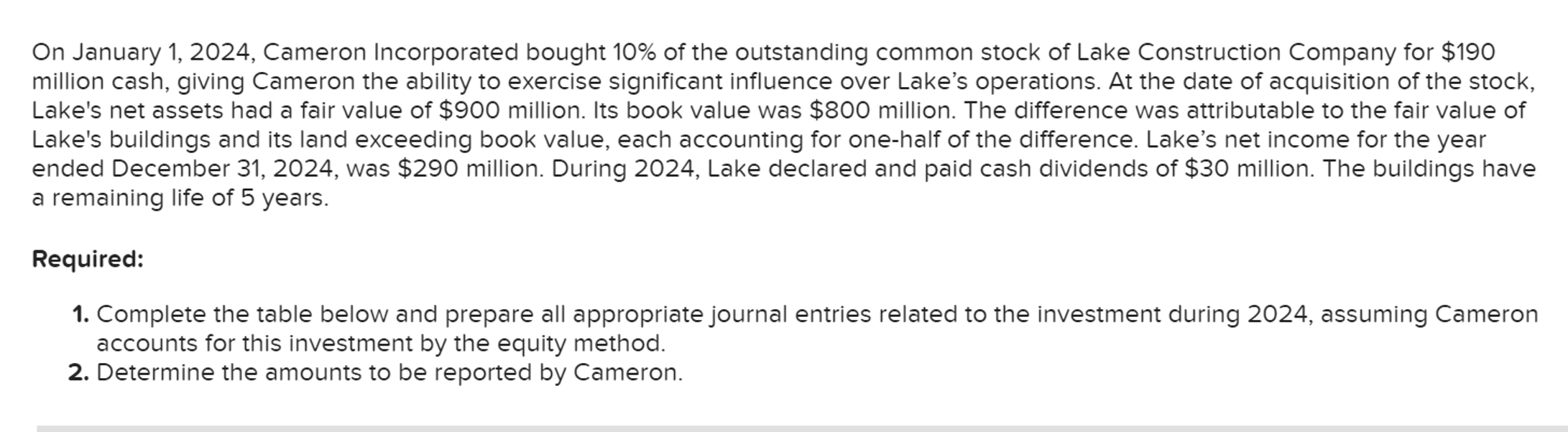

On January 1 , 2 0 2 4 , Cameron Incorporated bought 1 0 % of the outstanding common stock of Lake Construction Company for

On January Cameron Incorporated bought of the outstanding common stock of Lake Construction Company for $ Complete the table below.

Note: Enter your answers in millions, ie should be entered as

million cash, giving Cameron the ability to exercise significant influence over Lake's operations. At the date of acquisition of the stock,

Lake's net assets had a fair value of $ million. Its book value was $ million. The difference was attributable to the fair value of

Lake's buildings and its land exceeding book value, each accounting for onehalf of the difference. Lake's net income for the year

ended December was $ million. During Lake declared and paid cash dividends of $ million. The buildings have

a remaining life of years.

Required:

Complete the table below and prepare all appropriate journal entries related to the investment during assuming Cameron

accounts for this investment by the equity method.

Determine the amounts to be reported by Cameron.

Record the investment in Lake Construction shares.

Record the investor's share of net income.

Record the cash dividends.

Record the adjustment for depreciation.

Determine the amounts to be reported by Cameron.

Note: Amounts to be deducted, including losses and cash outflows, should be indicated with a minus sign. Enter your answers

in millions, ie should be entered as

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started