Answered step by step

Verified Expert Solution

Question

1 Approved Answer

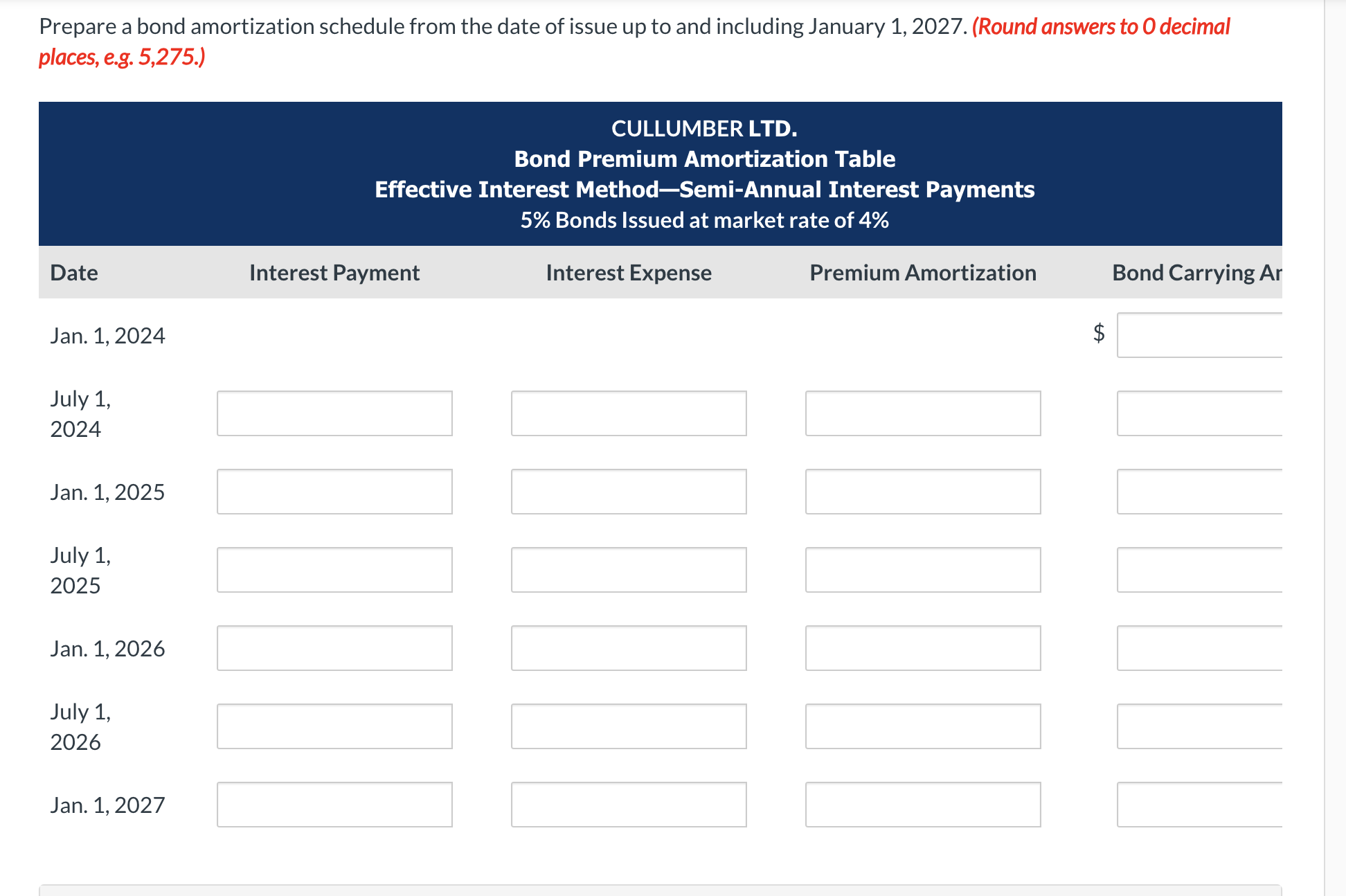

On January 1 , 2 0 2 4 , Cullumber Ltd . issued bonds with a maturity value of $ 7 . 8 0 million

On January Cullumber Ltd issued bonds with a maturity value of $ million when the market rate of interest was The bonds have a coupon contractual interest rate of and mature on January Interest on the bonds is payable semiannually on July and January of each year. The company's year end is December

Click here to view the factor table. Present Value of

Click here to view the factor table. Present Value of an Annuity of Prepare a bond amortization schedule from the date of issue up to and including January Round answers to decimal

places, eg

CULLUMBER LTD

Bond Premium Amortization Table

Effective Interest MethodSemiAnnual Interest Payments

Bonds Issued at market rate of

Date

Interest Payment

Interest Expense

Premium Amortization

Bond Carrying Ar

Jan.

July

Jan.

July

Jan.

July

Jan.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started