Answered step by step

Verified Expert Solution

Question

1 Approved Answer

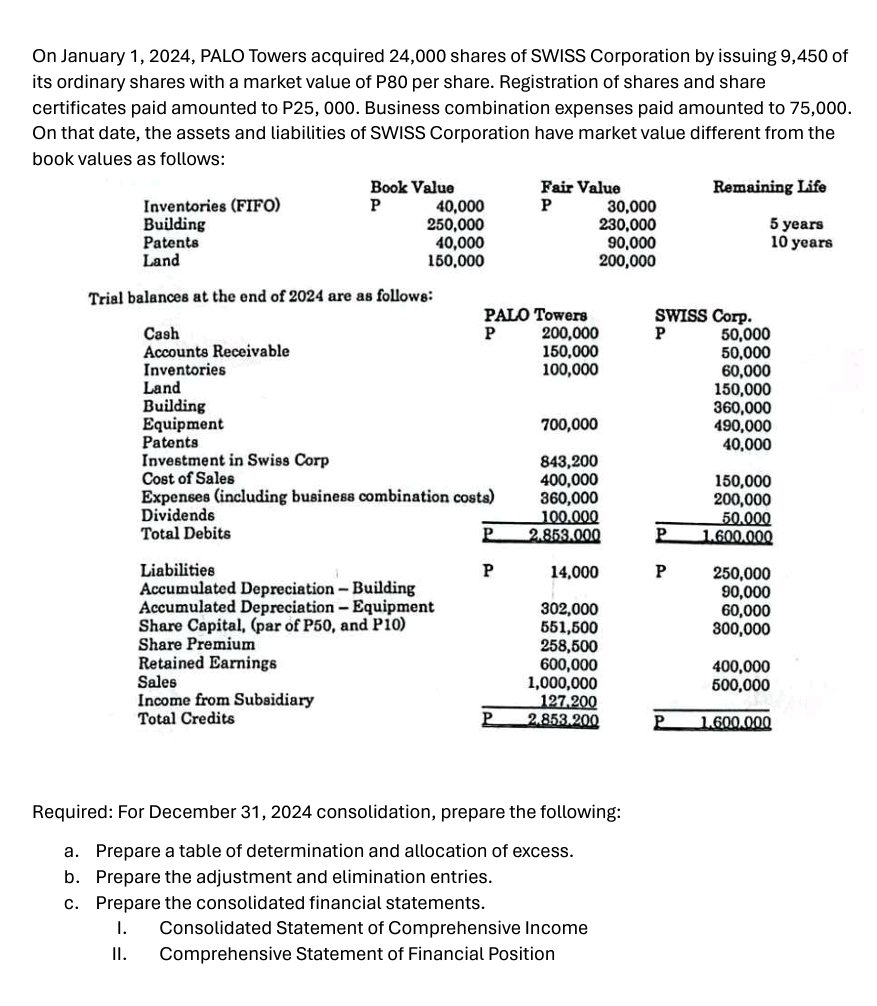

On January 1 , 2 0 2 4 , PALO Towers acquired 2 4 , 0 0 0 shares of SWISS Corporation by issuing 9

On January PALO Towers acquired shares of SWISS Corporation by issuing of

its ordinary shares with a market value of per share. Registration of shares and share

certificates paid amounted to Business combination expenses paid amounted to

On that date, the assets and liabilities of SWISS Corporation have market value different from the

book values as follows:

Required: For December consolidation, prepare the following:

a Prepare a table of determination and allocation of excess.

b Prepare the adjustment and elimination entries.

c Prepare the consolidated financial statements.

I. Consolidated Statement of Comprehensive Income

II Comprehensive Statement of Financial Position

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started