Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2006, Enterprise Inc. bought two trademarks; trademark A cost $50,000 and trademark B cost $60,000. Acquisition costs were $5,000 for A

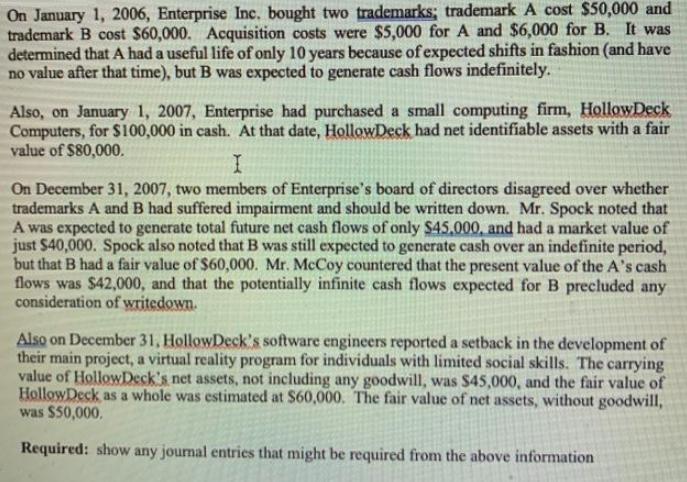

On January 1, 2006, Enterprise Inc. bought two trademarks; trademark A cost $50,000 and trademark B cost $60,000. Acquisition costs were $5,000 for A and $6,000 for B. It was determined that A had a useful life of only 10 years because of expected shifts in fashion (and have no value after that time), but B was expected to generate cash flows indefinitely. Also, on January 1, 2007, Enterprise had purchased a small computing firm, HollowDeck Computers, for $100,000 in cash. At that date, HollowDeck had net identifiable assets with a fair value of $80,000. I. On December 31, 2007, two members of Enterprise's board of directors disagreed over whether trademarks A and B had suffered impairment and should be written down. Mr. Spock noted that A was expected to generate total future net cash flows of only $45,000, and had a market value of just $40,000. Spock also noted that B was still expected to generate cash over an indefinite period, but that B had a fair value of $60,000. Mr. McCoy countered that the present value of the A's cash flows was $42,000, and that the potentially infinite cash flows expected for B precluded any consideration of writedown. Also on December 31, HollowDeck's software engineers reported a setback in the development of their main project, a virtual reality program for individuals with limited social skills. The carrying value of HollowDeck's net assets, not including any goodwill, was $45,000, and the fair value of HollowDeck as a whole was estimated at $60,000. The fair value of net assets, without goodwill, was $50,000, Required: show any journal entries that might be required from the above information

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Journal Entries in the books of interprice inc Date Account Title Debit Cr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started