Question

On January 1, 2009, (A) Co. acquired all of the common stock of (B) Corp. For 2009, (B) earned net income of JD 360,000

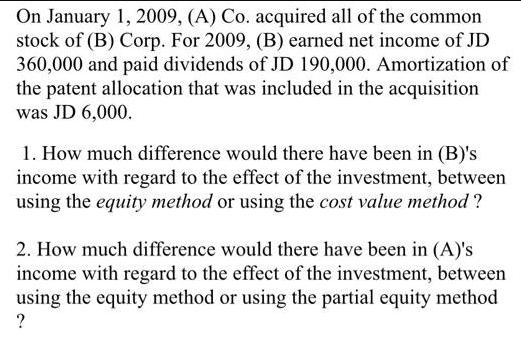

On January 1, 2009, (A) Co. acquired all of the common stock of (B) Corp. For 2009, (B) earned net income of JD 360,000 and paid dividends of JD 190,000. Amortization of the patent allocation that was included in the acquisition was JD 6,000. 1. How much difference would there have been in (B)'s income with regard to the effect of the investment, between using the equity method or using the cost value method? 2. How much difference would there have been in (A)'s income with regard to the effect of the investment, between using the equity method or using the partial equity method ?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 First calculating bs income to be adjusted in As investment as per equity method Adju...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Financial Accounting

Authors: Theodore E. Christensen, David M. Cottrell, Richard E. Baker

10th edition

78025621, 978-0078025624

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App