Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2009, Julie Enterprise has an equipment at cost RM135,620 and RM81,374 accumulated depreciations. In 2009, Julie Enterprise purchase new equipment at a

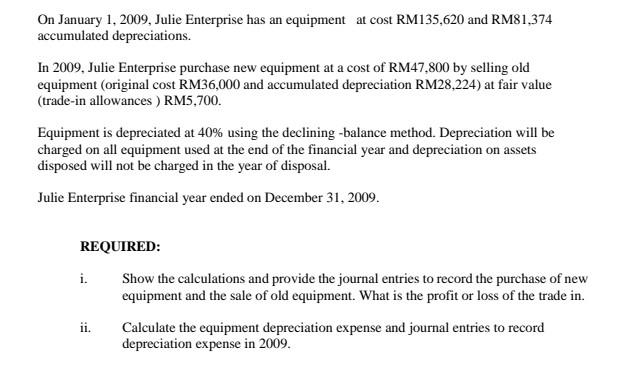

On January 1, 2009, Julie Enterprise has an equipment at cost RM135,620 and RM81,374 accumulated depreciations. In 2009, Julie Enterprise purchase new equipment at a cost of RM47,800 by selling old equipment (original cost RM36,000 and accumulated depreciation RM28,224) at fair value (trade-in allowances ) RM5,700. Equipment is depreciated at 40% using the declining -balance method. Depreciation will be charged on all equipment used at the end of the financial year and depreciation on assets disposed will not be charged in the year of disposal. Julie Enterprise financial year ended on December 31, 2009. REQUIRED: i. Show the calculations and provide the journal entries to record the purchase of new equipment and the sale of old equipment. What is the profit or loss of the trade in. ii. Calculate the equipment depreciation expense and journal entries to record depreciation expense in 2009

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started