Answered step by step

Verified Expert Solution

Question

1 Approved Answer

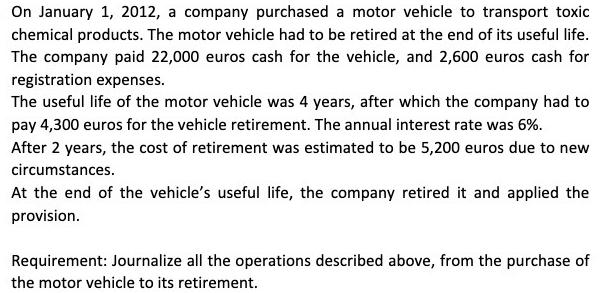

On January 1, 2012, a company purchased a motor vehicle to transport toxic chemical products. The motor vehicle had to be retired at the

On January 1, 2012, a company purchased a motor vehicle to transport toxic chemical products. The motor vehicle had to be retired at the end of its useful life. The company paid 22,000 euros cash for the vehicle, and 2,600 euros cash for registration expenses. The useful life of the motor vehicle was 4 years, after which the company had to pay 4,300 euros for the vehicle retirement. The annual interest rate was 6%. After 2 years, the cost of retirement was estimated to be 5,200 euros due to new circumstances. At the end of the vehicle's useful life, the company retired it and applied the provision. Requirement: Journalize all the operations described above, from the purchase of the motor vehicle to its retirement.

Step by Step Solution

★★★★★

3.29 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

January 1 2012 Debit Cash 22000 Credit Vehicle 22000 Debit Cash 2600 Credit R...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started