Question

[]On January 1, 2012, Paisano Company, a U.S. corporation, acquired 100% of the common stock of Chiara Company, an Italian chocolate company. It was determined

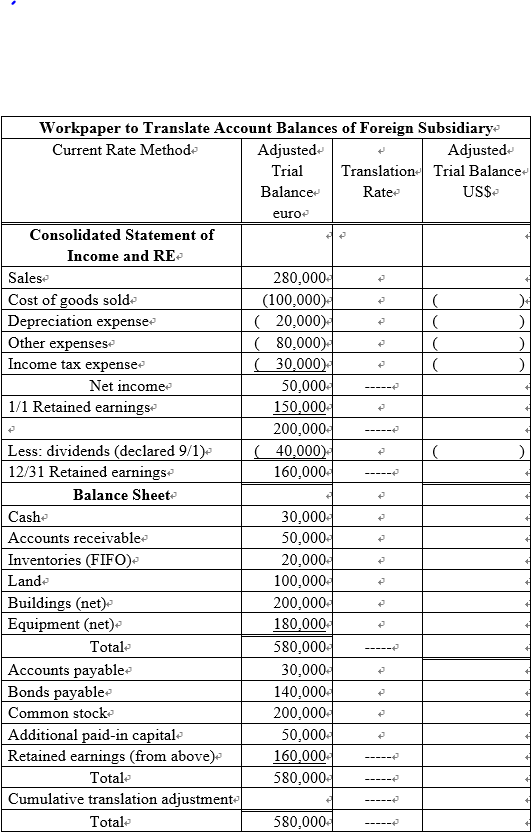

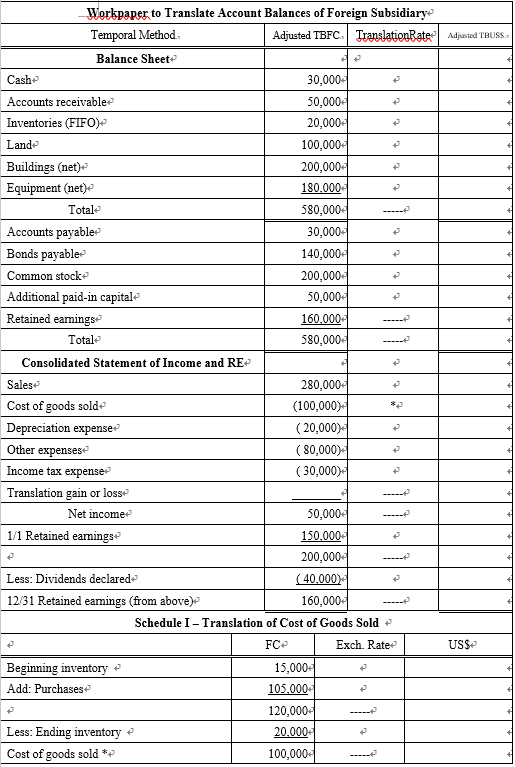

[]On January 1, 2012, Paisano Company, a U.S. corporation, acquired 100% of the common stock of Chiara Company, an Italian chocolate company. It was determined that the functional currency of Chiara was the euro. At the time of the combination, Chiaras retained earnings were 150,000 euros. Chiaras assets has all been purchased at its incorporation, January 2, 2010, and had a book value of 400,000 (70,000 net monetary assets) euros at the beginning of 2010. Relevant exchange rates are listed below. Chiara uses the FIFO method of inventory valuation and its ending inventory in both 2011 and 2012 was purchased in the last quarter of the year. Chiara declared dividends of $40,000 euros on September 1, 2012.

| Date | Exchange Rate |

| January 1, 2010 | .8542 |

| January 1, 2012 | 1.0451 |

| September 1, 2012 | 1.1572 |

| Decemeber 31, 2012 | 1.1762 |

| Average for 2012 | 1.1106 |

| Average for last 3 months of 2012 | 1.1667 |

| Average for last 3 months of 2011 | 1.0223 |

A. Complet the worksheet below, assuming the current rate method

[] Using the information from [] assume the functional currency is the US$. Complete the attached worksheet, assuming the temporal method.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started