Question

The analysis of the ratio of Xera Industries based on industry averages are as below : Liquidity Ratios Current ratio Quick ratio Activity Ratios

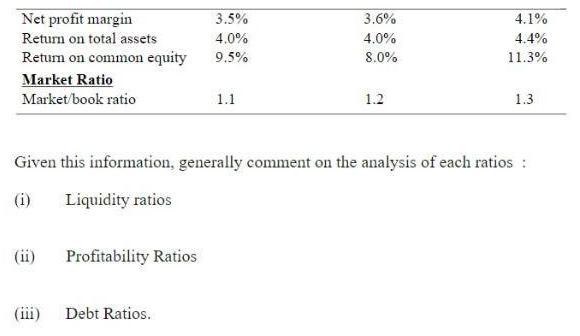

The analysis of the ratio of Xera Industries based on industry averages are as below : Liquidity Ratios Current ratio Quick ratio Activity Ratios Inventory turnover Average collection period Debt Ratios Debt ratio Times interest earned Xera Industries-Ratio Analysis Actual 2018 Profitability Ratios Gross profit margin Industry Average 1.80 0.70 2.50 37.5 days 65% 3.8 38% 1.84 0.78 2.59 36.5 days 67% 4.0 40% Actual 2019 1.04 0.38 2.33 57 days 61.3% 2.8 34% Net profit margin Return on total assets Return on common equity Market Ratio Market/book ratio (ii) Profitability Ratios 3.5% 4.0% 9.5% Debt Ratios. 1.1 3.6% 4.0% 8.0% 1.2 Given this information, generally comment on the analysis of each ratios: (i) Liquidity ratios 4.1% 4.4% 11.3% 1.3.

Step by Step Solution

3.33 Rating (174 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting

Authors: Walter Harrison, Charles Horngren, William Thomas, Wendy Tietz

11th edition

978-0134065830, 134065832, 134127625, 978-0134127620

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App