Answered step by step

Verified Expert Solution

Question

1 Approved Answer

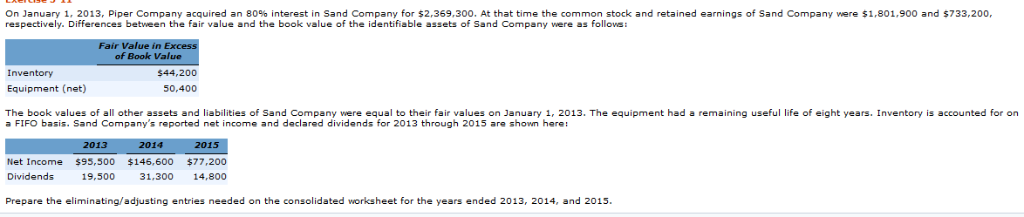

On January 1, 2013, Piper Company acquired an 80% interest respectively, Differences between the fair value and the book value of the identifiable assets of

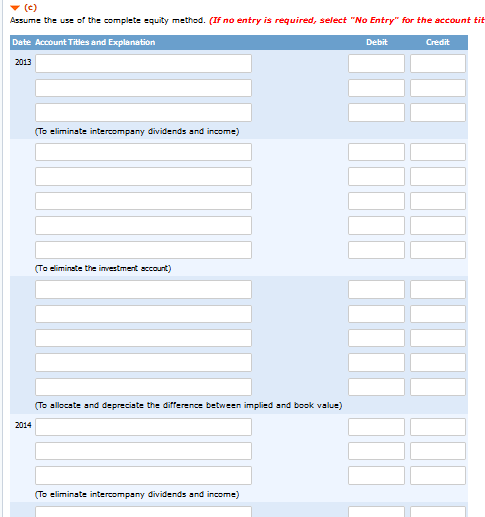

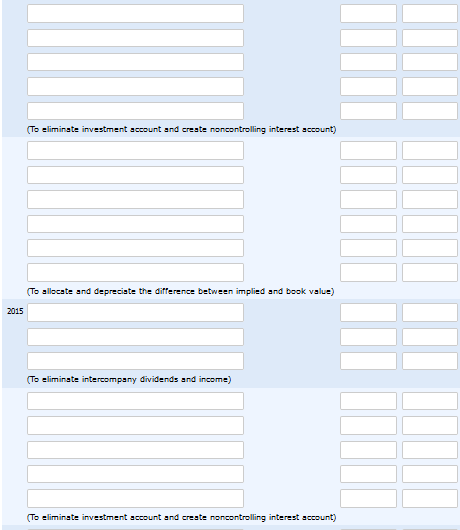

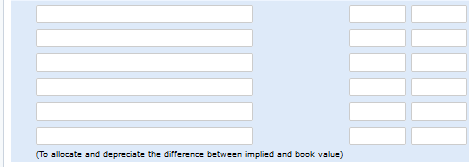

On January 1, 2013, Piper Company acquired an 80% interest respectively, Differences between the fair value and the book value of the identifiable assets of Sand Company were a Sand Company for $2,369,300. At that time the common stock and retained earnings of Sand Company were $1,801,900 and $733,200, follows Fair Value in Excess of Book Value Inventory $44,200 Equipment (net) 50,400 accounted for on The book values of all other assets and liabilities of Sand Company were equal to their fair values on January a FIFO basis. Sand Company's reported net income and declared dividends for 2013 through 2015 are shown here: 2013. The equipment had a remaining useful life eight years. Inventory 2013 2014 2015 Net Income $95,500 $146.600 $77,200 Dividends 19.500 31.300 14,800 Prepare the eliminating/adjusting entries needed on the consolidated worksheet for the years ended 2013, 2014, and 2015. (c) Assume the use of the complete equity method. (If no entry is required, select "No Entry" for the account tit Date Account Titles and Explanation Debit Credit 2013 To eliminate intercompany dividends and income) (To iminate the imvestment account) To allocate and depreciate the difference between implied and book value) 2014 To eliminate intercompany dividends and income) To eliminate investment account and create noncontrolling interest account) To allocate and depreciate the difference between implied and book value) 2015 (To eliminate intercompany dividends and income) (To eliminate investment account and create noncontrolling interest account) (To allocate and depreciate the difference between im plied and book value)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started