Answered step by step

Verified Expert Solution

Question

1 Approved Answer

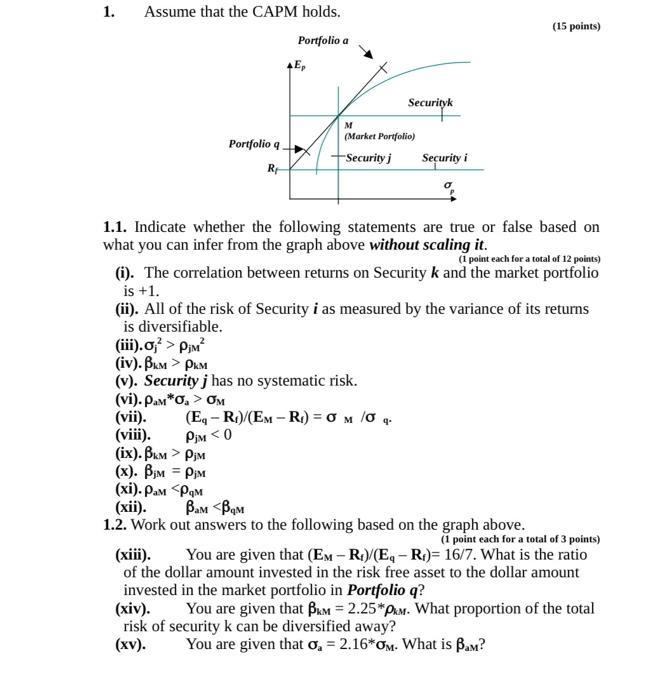

1. Assume that the CAPM holds. Portfolio a Ep Portfolio q Rr M (Market Portfolio) Security j (vii). (viii). (ix). BKM > PIM (x).

1. Assume that the CAPM holds. Portfolio a Ep Portfolio q Rr M (Market Portfolio) Security j (vii). (viii). (ix). BKM > PIM (x). Bim = Pim (xi). PaM PjM (iv). BKM > PKM (v). Security j has no systematic risk. (vi). Pam*O > OM 1.1. Indicate whether the following statements are true or false based on what you can infer from the graph above without scaling it. (1 point each for a total of 12 points) (i). The correlation between returns on Security k and the market portfolio is +1. (Eq-R)/(EM-R) = 0 M /0 9. PIM

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635e31e5dec0f_182257.pdf

180 KBs PDF File

635e31e5dec0f_182257.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started