On January 1, 2014, a U.S. company purchased 100% of the outstanding stock of Ventana Grains, a company located in Latz City, New Zealand.

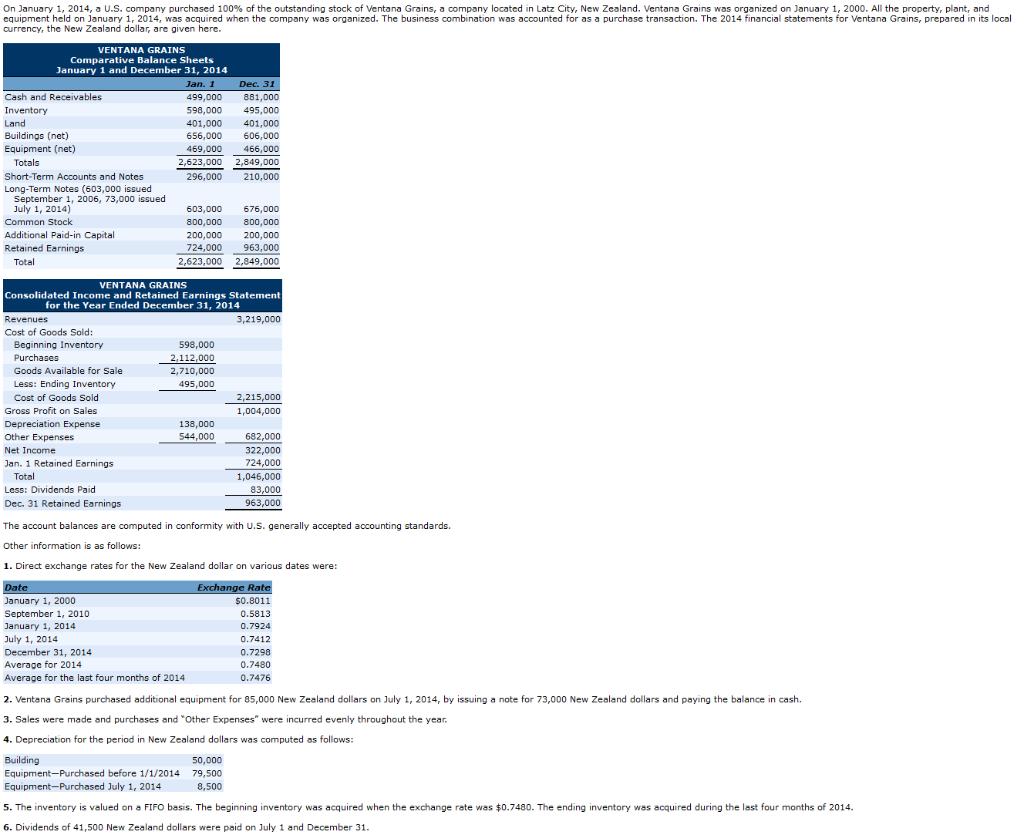

On January 1, 2014, a U.S. company purchased 100% of the outstanding stock of Ventana Grains, a company located in Latz City, New Zealand. Ventana Grains was organized on January 1, 2000. All the property, plant, and equipment held on January 1, 2014, was acquired when the company was organized. The business combination was accounted for as a purchase transaction. The 2014 financial statements for Ventana Grains, prepared in its local currency, the New Zealand dollar, are given here. VENTANA GRAINS Comparative Balance Sheets January 1 and December 31, 2014 Cash and Receivables Inventory Land Buildings (net) Equipment (net) Totals Short-Term Accounts and Notes Long-Term Notes (603,000 issued September 1, 2006, 73,000 issued July 1, 2014) Common Stock Additional Paid-in Capital Retained Earnings Total Revenues Cost of Goods Sold: Beginning Inventory Purchases Goods Available for Sale Less: Ending Inventory. Cost of Goods Sold Gross Profit on Sales Depreciation Expense VENTANA GRAINS Consolidated Income and Retained Earnings Statement for the Year Ended December 31, 2014 Other Expenses Net Income Jan. 1 Retained Earnings Total Less: Dividends Paid Dec. 31 Retained Earnings Jan. 1 Dec. 31 499,000 881,000 598,000. 495,000 401,000 401,000 656,000 606,000 469,000 466,000 2,623,000 2,849,000 296,000 210,000 Date January 1, 2000 September 1, 2010 January 1, 2014 July 1, 2014 603,000 676,000 800,000 800,000 200,000 200,000 724,000 963,000 2,623,000 2,849,000 598,000 2,112,000 2,710,000 495,000 138,000 544.000 December 31, 2014 Average for 2014 Average for the last four months of 2014 3,219,000 The account balances are computed in conformity with U.S. generally accepted accounting standards. Other information is as follows: 1. Direct exchange rates for the New Zealand dollar on various dates were: 2,215,000 1,004,000 682,000 322,000 724,000 1,046,000 83,000 963,000. 50,000 79,500 8,500 Exchange Rate $0.8011 0.5813 0.7924 0.7412 0.7298 0.7480 0.7476 2. Ventana Grains purchased additional equipment for 85,000 New Zealand dollars on July 1, 2014, by issuing a note for 73,000 New Zealand dollars and paying the balance in cash. 3. Sales were made and purchases and "Other Expenses" were incurred evenly throughout the year. 4. Depreciation for the period in New Zealand dollars was computed as follows: Building Equipment Purchased before 1/1/2014 Equipment-Purchased July 1, 2014 5. The inventory is valued on a FIFO basis. The beginning inventory was acquired when the exchange rate was $0.7480. The ending inventory was acquired during the last four months of 2014. 6. Dividends of 41,500 New Zealand dollars were paid on July 1 and December 31. Remeasure the financial statements into dollars assuming that the U.S. dollar was identified as the functional currency of the foreign subsidiary. (Round answers to 0 decimal places, e.g. 5,125. Enter loss using either a negative sign preceding the number e.g. -2,945 or parentheses e.g. (2,945).) Balance Sheet Totals Totals Consolidated Statement of Income and Retained Earnings New Zealand $ Translation Rate U.S. $

Step by Step Solution

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Consolidated statement of income and Retained earnings New zealand Translation Rate US Revenue ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started