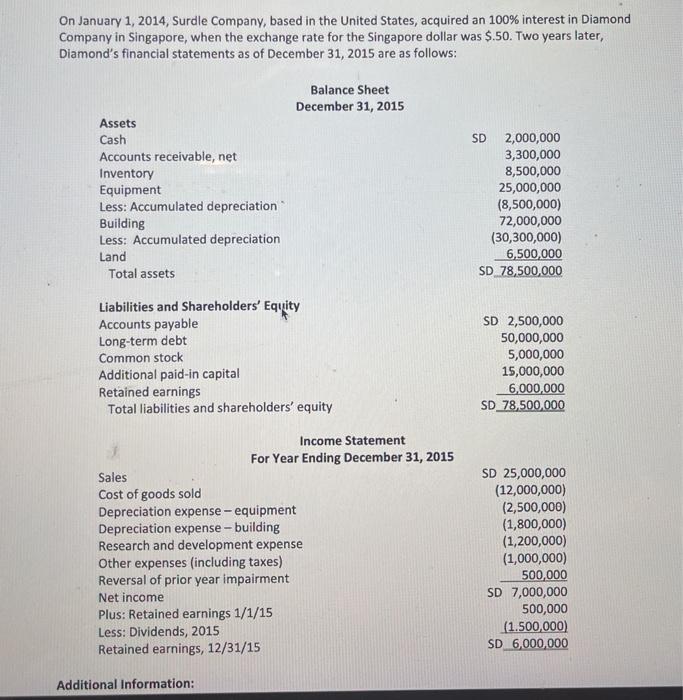

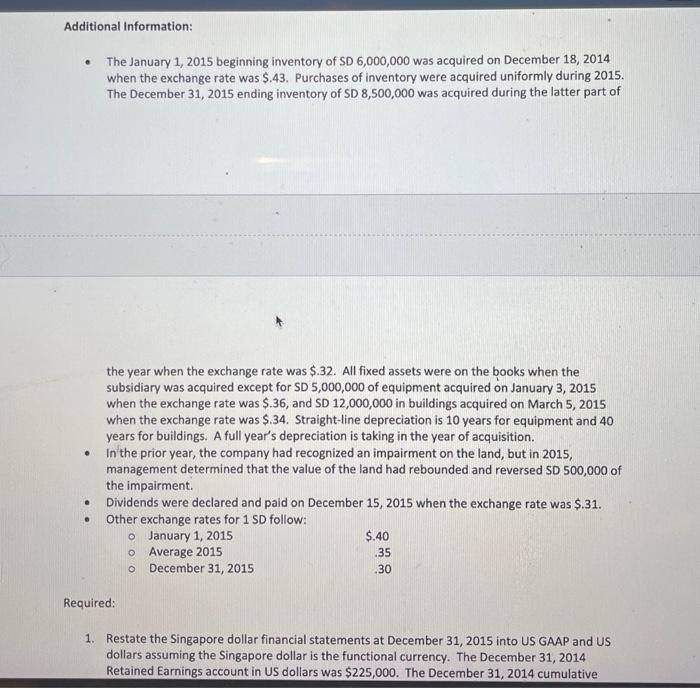

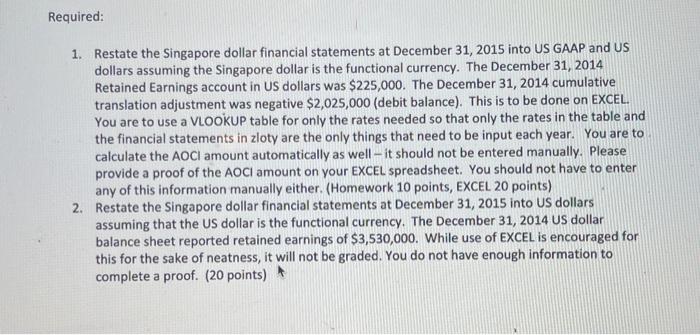

On January 1, 2014, Surdle Company, based in the United States, acquired an 100% interest in Diamond Company in Singapore, when the exchange rate for the Singapore dollar was $.50. Two years later, Diamond's financial statements as of December 31,2015 are as follows: - The January 1, 2015 beginning inventory of SD 6,000,000 was acquired on December 18,2014 when the exchange rate was $.43. Purchases of inventory were acquired uniformly during 2015. The December 31,2015 ending inventory of SD 8,500,000 was acquired during the latter part of the year when the exchange rate was $32. All fixed assets were on the books when the subsidiary was acquired except for SD 5,000,000 of equipment acquired on January 3, 2015 when the exchange rate was \$.36, and SD 12,000,000 in buildings acquired on March 5, 2015 when the exchange rate was $.34. Straight-line depreciation is 10 years for equipment and 40 years for buildings. A full year's depreciation is taking in the year of acquisition. - In the prior year, the company had recognized an impairment on the land, but in 2015 , management determined that the value of the land had rebounded and reversed SD 500,000 of the impairment. - Dividends were declared and paid on December 15, 2015 when the exchange rate was $.31. - Other exchange rates for 1 SD follow: equired: 1. Restate the Singapore dollar financial statements at December 31,2015 into US GAAP and US dollars assuming the Singapore dollar is the functional currency. The December 31, 2014 Retained Earnings account in US dollars was $225,000. The December 31,2014 cumulative 1. Restate the Singapore dollar financial statements at December 31,2015 into US GAAP and US dollars assuming the Singapore dollar is the functional currency. The December 31, 2014 Retained Earnings account in US dollars was $225,000. The December 31, 2014 cumulative translation adjustment was negative $2,025,000 (debit balance). This is to be done on EXCEL. You are to use a VLOOKUP table for only the rates needed so that only the rates in the table and the financial statements in zloty are the only things that need to be input each year. You are to calculate the AOCl amount automatically as well - it should not be entered manually. Please provide a proof of the AOCl amount on your EXCEL spreadsheet. You should not have to enter any of this information manually either. (Homework 10 points, EXCEL 20 points) 2. Restate the Singapore dollar financial statements at December 31,2015 into US dollars assuming that the US dollar is the functional currency. The December 31, 2014 US dollar balance sheet reported retained earnings of $3,530,000. While use of EXCEL is encouraged for this for the sake of neatness, it will not be graded. You do not have enough information to complete a proof. (20 points)