Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2015, Brooks Inc. borrows $90,000 from a bank and signs a 5% installment note requiring four annual payments of $25,381. Click

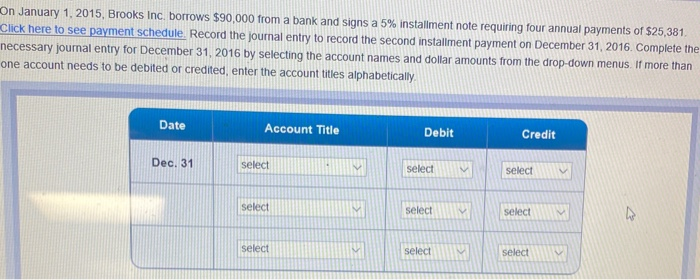

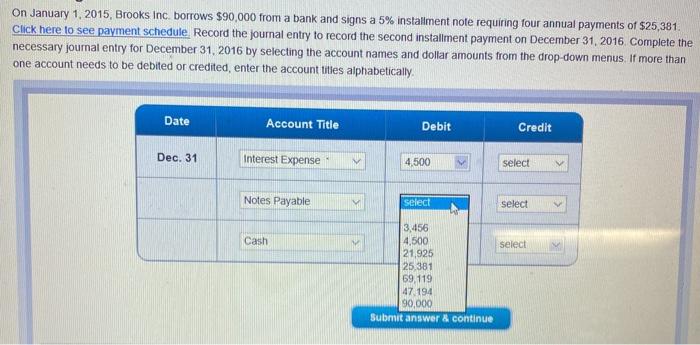

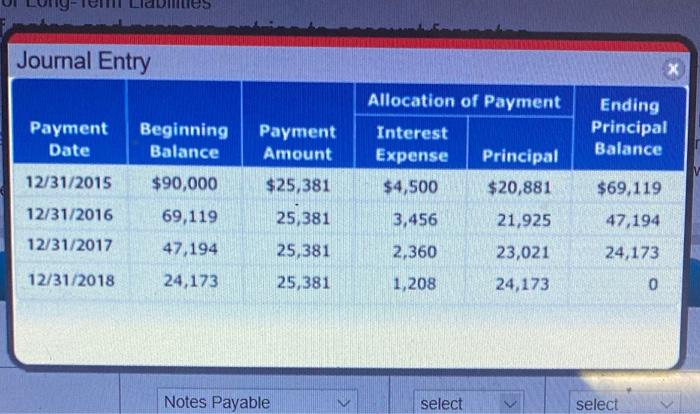

On January 1, 2015, Brooks Inc. borrows $90,000 from a bank and signs a 5% installment note requiring four annual payments of $25,381. Click here to see payment schedule. Record the journal entry to record the second installment payment on December 31 , 2016. Complete the necessary journal entry for December 31, 2016 by selecting the account names and dollar amounts from the drop-down menus. If more than one account needs to be debited or credited, enter the account titles alphabetically. Date Account Title Debit Credit Dec. 31 select select select select select select select select select On January 1, 2015, Brooks Inc. borrows $90,000 from a bank and signs a 5% installment note requiring four annual payments of $25,381. Click here to see payment schedule Record the journal entry to record the second installment payment on December 31, 2016. Complete the necessary journal entry for December 31, 2016 by selecting the account names and dollar amounts from the drop-down menus. If more than one account needs to be debited or credited, enter the account titles alphabetically. Date Account Title Debit Credit Dec. 31 Interest Expense 4,500 select Notes Payable select select 3,456 4,500 21,925 Cash select 25,381 69,119 47.194 90,000 Submit answer & continue Journal Entry Allocation of Payment Ending Principal Balance Payment Beginning Payment Interest Date Balance Amount Expense Principal 12/31/2015 $90,000 $25,381 $4,500 $20,881 $69,119 12/31/2016 69,119 25,381 3,456 21,925 47,194 12/31/2017 47,194 25,381 2,360 23,021 24,173 12/31/2018 24,173 25,381 1,208 24,173 Notes Payable select select

Step by Step Solution

★★★★★

3.30 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Answer Step by Step Explanation Date Account Title Debit Credit Dec 31 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started