Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2015, Green Company acquired 5-year bonds with a total face value of P5, 000, 000 for P5, 379, 079. The bonds

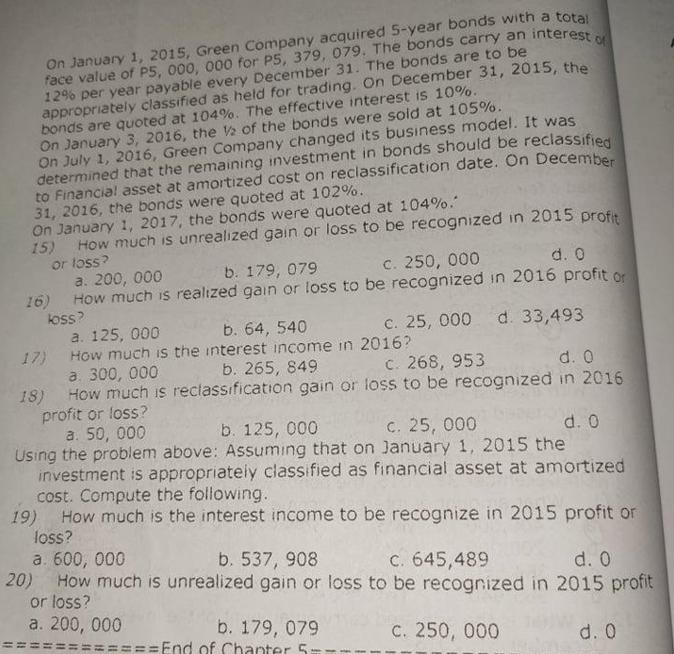

On January 1, 2015, Green Company acquired 5-year bonds with a total face value of P5, 000, 000 for P5, 379, 079. The bonds carry an interest of 12% per year payable every December 31. The bonds are to be appropriately classified as held for trading. On December 31, 2015, the bonds are quoted at 104%. The effective interest is 10%. On January 3, 2016, the 2 of the bonds were sold at 105%. On July 1, 2016, Green Company changed its business model. It was determined that the remaining investment in bonds should be reclassified to Financial asset at amortized cost on reclassification date. On December 31, 2016, the bonds were quoted at 102%. On January 1, 2017, the bonds were quoted at 104%." 15) How much is unrealized gain or loss to be recognized in 2015 profit or loss? a. 200, 000 b. 179, 079 c. 250, 000 d. 0 16) How much is realized gain or loss to be recognized in 2016 profit or loss? a. 125, 000 b. 64, 540 17) How much is the interest income in 2016? a. 300,000 b. 265, 849 c. 268, 953 d. 0 18) How much is reclassification gain or loss to be recognized in 2016 profit or loss? c. 25, 000 d. 33,493 a. 50, 000 b. 125, 000 c. 25,000 d. 0 Using the problem above: Assuming that on January 1, 2015 the investment is appropriately classified as financial asset at amortized cost. Compute the following. 19) How much is the interest income to be recognize in 2015 profit or loss? a. 600, 000 b. 537, 908 c. 645,489 d. 0 20) How much is unrealized gain or loss to be recognized in 2015 profit or loss? a. 200, 000 c. 250, 000 d. 0 b. 179, 079 End of Chanter

Step by Step Solution

★★★★★

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

15 b 179 0 79 The unreal ized gain or loss to be recognized in 2015 profit or loss is P 179 07 9 Thi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started