Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2015, Stiller Co. purchased $80,000,000 in 9% bonds that will mature in 6 years. Management intends to have the investment available-for-sale

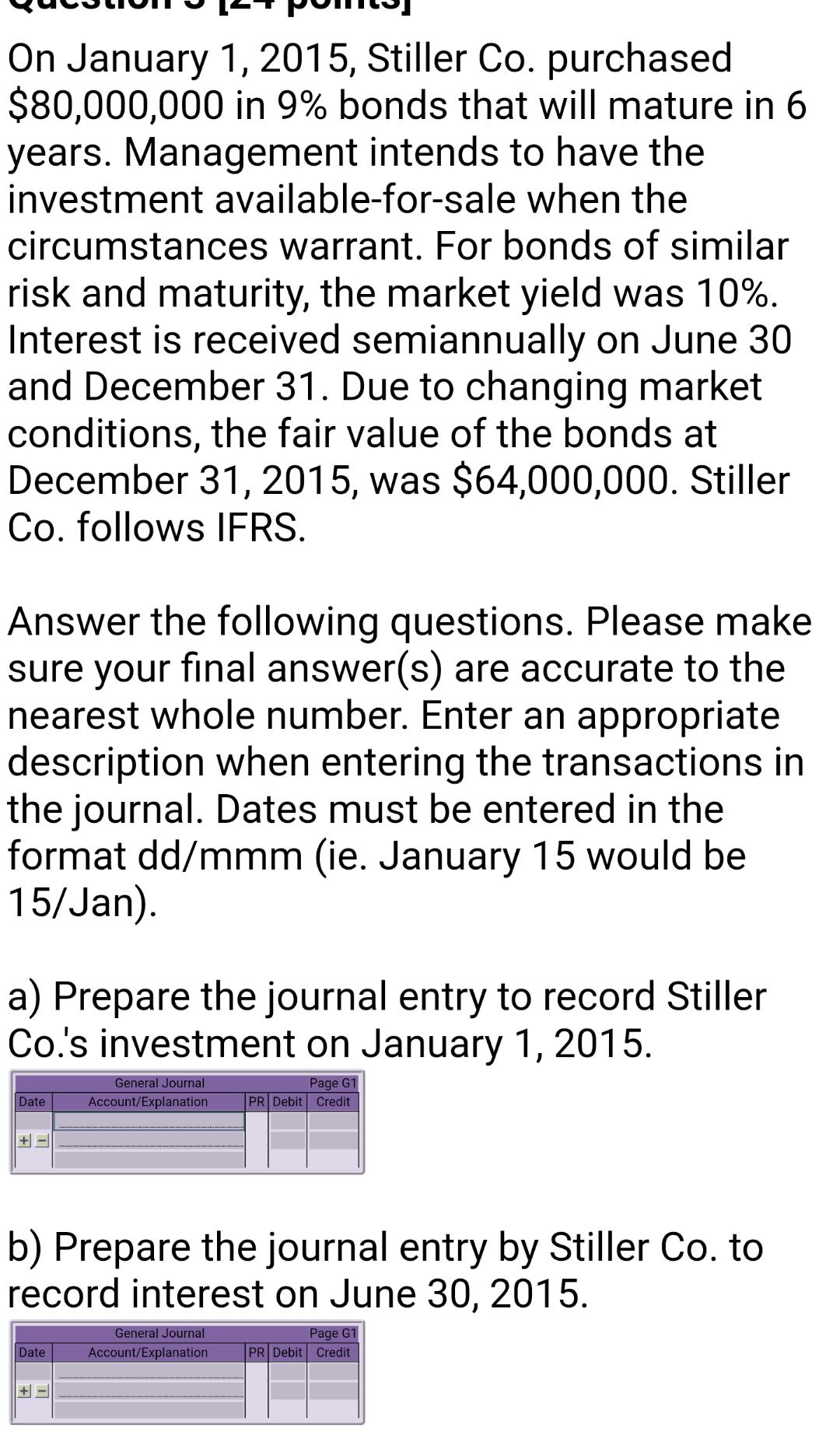

On January 1, 2015, Stiller Co. purchased $80,000,000 in 9% bonds that will mature in 6 years. Management intends to have the investment available-for-sale when the circumstances warrant. For bonds of similar risk and maturity, the market yield was 10%. Interest is received semiannually on June 30 and December 31. Due to changing market conditions, the fair value of the bonds at December 31, 2015, was $64,000,000. Stiller Co. follows IFRS. Answer the following questions. Please make sure your final answer(s) are accurate to the nearest whole number. Enter an appropriate description when entering the transactions in the journal. Dates must be entered in the format dd/mmm (ie. January 15 would be 15/Jan). a) Prepare the journal entry to record Stiller Co.'s investment on January 1, 2015. Date Date General Journal Account/Explanation b) Prepare the journal entry by Stiller Co. to record interest on June 30, 2015. +- Page G1 PR Debit Credit General Journal Account/Explanation Page G1 PR Debit Credit c) Prepare the journal entry by Stiller Co. to record interest on December 31, 2015. Date +- General Journal Account/Explanation Date d) Prepare the adjustment necessary to report Stiller Co.'s investment on the December 31, 2015 balance sheet. Page G1 PR Debit Credit General Journal Account/Explanation Page G1 PR Debit Credit e) What amounts will Stiller Co. report for its investment on the December 31, 2015 balance sheet? Carrying value = Accumulated other comprehensive income (AOCI) =

Step by Step Solution

★★★★★

3.53 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Journal entries The journal entries for the investment in bonds can be poste...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started