Answered step by step

Verified Expert Solution

Question

1 Approved Answer

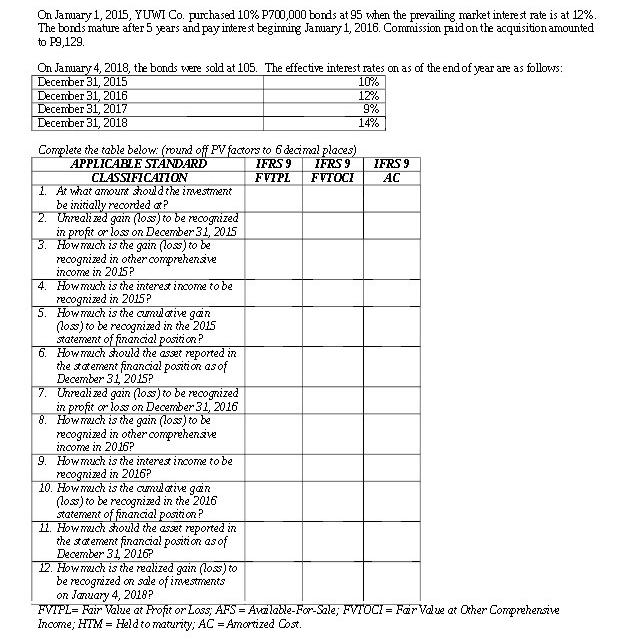

On January 1, 2015, YUWI Co. purchased 10% P700,000 bonds at 95 when the prevailing market interest rate is at 12%. The bonds mature

On January 1, 2015, YUWI Co. purchased 10% P700,000 bonds at 95 when the prevailing market interest rate is at 12%. The bonds mature after 5 years and pay interest beginning January 1, 2016. Commission paid on the acquisition amounted to P9,129. On January 4, 2018, the bonds were sold at 105. The effective interest rates on as of the end of year are as follows: December 31, 2015 December 31, 2016 December 31, 2017 December 31, 2018 Complete the table below: (round off PV factors to 6 decimal places) APPLICABLE STANDARD CLASSIFICATION 1. At what amount should the investment IFRS 9 FVTPL 10% 12% 9% 14% IFRS 9 IFRS 9 FVTOCI AC be initially recorded at? 2. Unrealized gain (loss) to be recognized in profit or loss on December 31, 2015 3. How much is the gain (loss) to be recognized in other comprehensive income in 2015? 4. How much is the interest income to be recognized in 2015? 5. How much is the cumulative gain (loss) to be recognized in the 2015 statement of financial position? 6. How much should the asset reported in the statement financial position as of December 31, 2015? 7. Unrealized gain (loss) to be recognized in profit or loss on December 31, 2016 8. How much is the gain (loss) to be recognized in other comprehensive income in 2016? 9. How much is the interest income to be recognized in 2016? 10. How much is the cumulative gain (loss) to be recognized in the 2016 statement of financial position? 11. How much should the asset reported in the statement financial position as of December 31, 2016? 12. How much is the realized gain (loss) to be recognized on sale of investments on January 4, 2018? FVTPL= Fair Value at Profit or Loss; AFS = Available-For-Sale; FVTOCI = Far Value at Other Comprehensive Income; HTM Held to maturity; AC - Amortized Cost.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started