Answered step by step

Verified Expert Solution

Question

1 Approved Answer

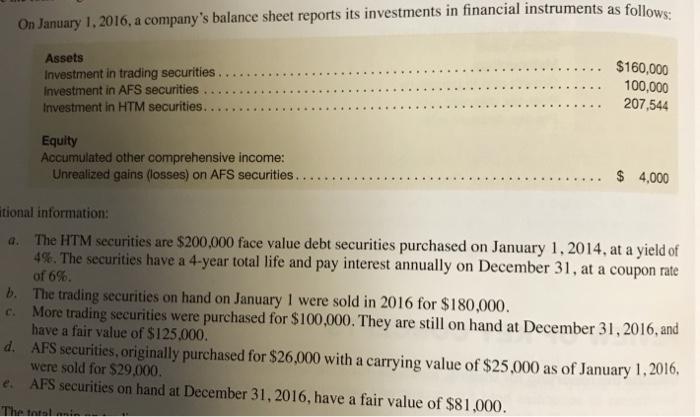

On January 1, 2016, a company's balance sheet reports its investments in financial instruments as follows: Assets Investment in trading securities.. Investment in AFS

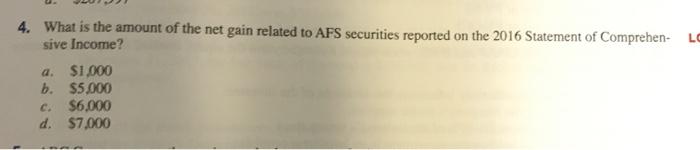

On January 1, 2016, a company's balance sheet reports its investments in financial instruments as follows: Assets Investment in trading securities.. Investment in AFS securities. Investment in HTM securities... Equity Accumulated other comprehensive income: Unrealized gains (losses) on AFS securities.. $160,000 100,000 207,544 $ 4,000 itional information: a. The HTM securities are $200,000 face value debt securities purchased on January 1, 2014, at a yield of 4%. The securities have a 4-year total life and pay interest annually on December 31, at a coupon rate of 6%. b. The trading securities on hand on January 1 were sold in 2016 for $180,000. C. More trading securities were purchased for $100,000. They are still on hand at December 31, 2016, and have a fair value of $125,000. d. AFS securities, originally purchased for $26,000 with a carrying value of $25,000 as of January 1, 2016. were sold for $29,000. e. AFS securities on hand at December 31, 2016, have a fair value of $81,000. The total nin 4. What is the amount of the net gain related to AFS securities reported on the 2016 Statement of Comprehen- sive Income? a. $1,000 b. $5,000 c. $6,000 d. $7,000 LC

Step by Step Solution

★★★★★

3.50 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

What is the amount of net gain related to reported in 2016 Investm...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started