Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. 3. 4. 5.2 5.3 5.4 5.5 STION 5 (20 Marks) Where applicable, use the present value tables provided in APPENDICES 1 and 2

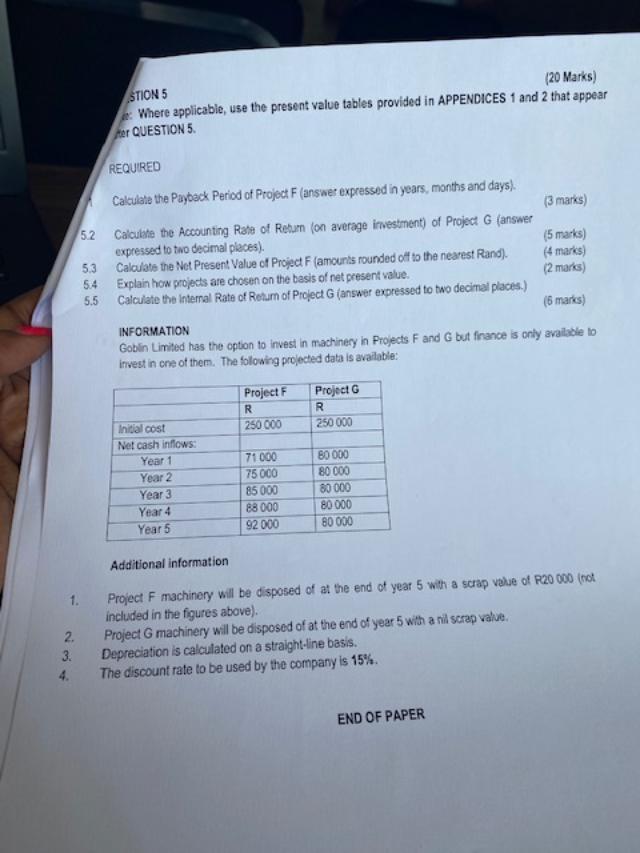

2. 3. 4. 5.2 5.3 5.4 5.5 STION 5 (20 Marks) Where applicable, use the present value tables provided in APPENDICES 1 and 2 that appear her QUESTION 5. REQUIRED Calculate the Payback Period of Project F (answer expressed in years, months and days). Calculate the Accounting Rate of Return (on average investment) of Project G (answer expressed to two decimal places). Calculate the Net Present Value of Project F (amounts rounded off to the nearest Rand). Explain how projects are chosen on the basis of net present value. Calculate the Internal Rate of Return of Project G (answer expressed to two decimal places.) (5 marks) (4 marks) (2 marks) (6 marks) INFORMATION Goblin Limited has the option to invest in machinery in Projects F and G but finance is only available to invest in one of them. The following projected data is available: Initial cost Net cash inflows: Year 1 Year 2 Year 3 Year 4 Year 5 Project F R 250 000 71 000 75 000 85 000 88 000 92 000 Project G R 250 000 80 000 80 000 80 000 80 000 80 000 (3 marks) Additional information Project F machinery will be disposed of at the end of year 5 with a scrap value of R20 000 (not included in the figures above). Project G machinery will be disposed of at the end of year 5 with a nill scrap value. Depreciation is calculated on a straight-line basis. The discount rate to be used by the company is 15%. END OF PAPER

Step by Step Solution

★★★★★

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

51 Payback period Project A Capital outlay in USD Cash inf...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started