Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2016 Baker Company purchased 300 of the 900 shares of Able Company for $30,000 On January 1, the book value of

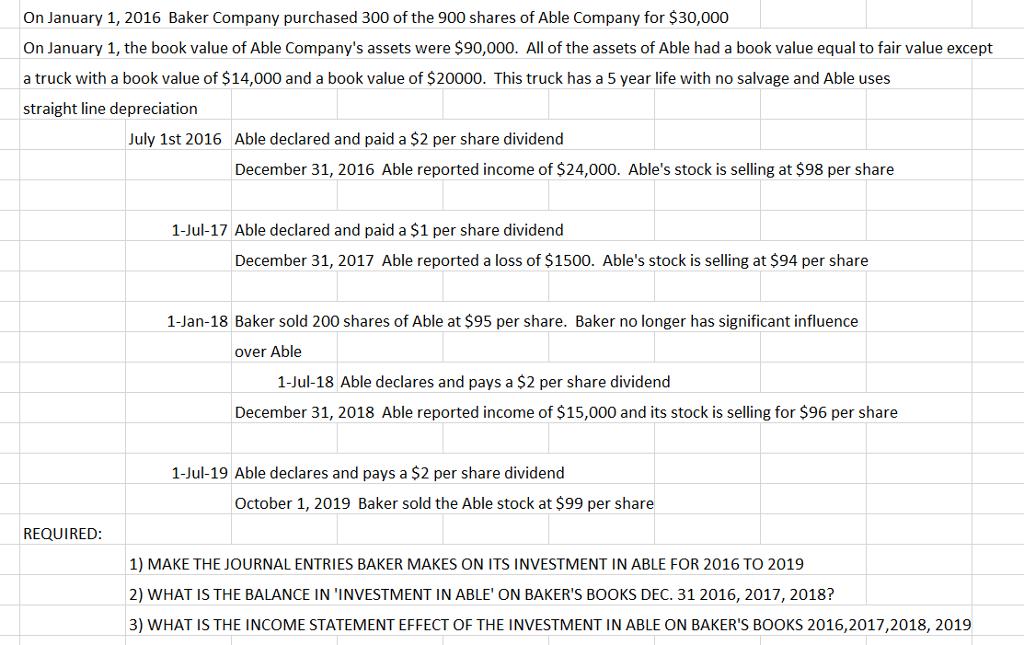

On January 1, 2016 Baker Company purchased 300 of the 900 shares of Able Company for $30,000 On January 1, the book value of Able Company's assets were $90,000. All of the assets of Able had a book value equal to fair value except a truck with a book value of $14,000 and a book value of $20000. This truck has a 5 year life with no salvage and Able uses straight line depreciation REQUIRED: July 1st 2016 Able declared and paid a $2 per share dividend December 31, 2016 Able reported income of $24,000. Able's stock is selling at $98 per share 1-Jul-17 Able declared and paid a $1 per share dividend December 31, 2017 Able reported a loss of $1500. Able's stock is selling at $94 per share 1-Jan-18 Baker sold 200 shares of Able at $95 per share. Baker no longer has significant influence over Able 1-Jul-18 Able declares and pays a $2 per share dividend December 31, 2018 Able reported income of $15,000 and its stock is selling for $96 per share 1-Jul-19 Able declares and pays a $2 per share dividend October 1, 2019 Baker sold the Able stock at $99 per share 1) MAKE THE JOURNAL ENTRIES BAKER MAKES ON ITS INVESTMENT IN ABLE FOR 2016 TO 2019 2) WHAT IS THE BALANCE IN 'INVESTMENT IN ABLE' ON BAKER'S BOOKS DEC. 31 2016, 2017, 2018? 3) WHAT IS THE INCOME STATEMENT EFFECT OF THE INVESTMENT IN ABLE ON BAKER'S BOOKS 2016,2017,2018, 2019

Step by Step Solution

★★★★★

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

1 Journal Entries for Bakers Investment in Able 20162019 2016 January 1 2016 Debit Investment in Abl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started