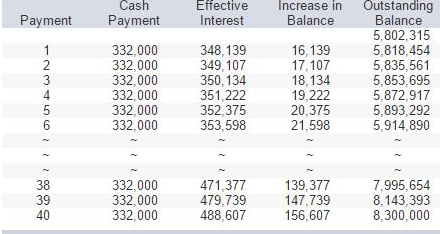

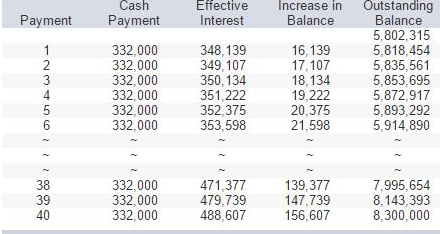

| On January 1, 2016, Tennessee Harvester Corporation issued debenture bonds that pay interest semiannually on June 30 and December 31. Portions of the bond amortization schedule appear below:

| 1. | What is the face amount of the bonds? | |

| 2. | What is the initial selling price of the bonds? |

| 3. | What is the term to maturity in years? |

| 4. | Interest is determined by what approach? | | | | | | | Effective interest rate | | Straight-line approach | | | 5. | What is the stated annual interest rate? | | 6. | What is the effective annual interest rate? | | 7. | What is the total cash interest paid over the term to maturity? | | |

| | |

| 8. | What is the total effective interest expense recorded over the term to maturity? | | |

Cash Effective increase in Outstanding Payment Payment Interest Balance Balance 5,802,315 5,818,454 16,139 332.000 348,139 332,000 349,107 17,107 5,835,561 332,000 18,134 5,853,695 350,134 332,000 351,222 19,222 5,872,917 332,000 352.375 5,893,292 20,375 5,914,890 332,000 21,598 353,598 332,000 471,377 139.377 7,995,654 38 332,000 39 479,739 147,739 8,143,393 8,300,000 40 488,607 156,607 332,000