Question

On January 1, 2017 Baker Company purchased a new delivery van for $84,000 that had an expected salvage value of $12,000. Its useful life

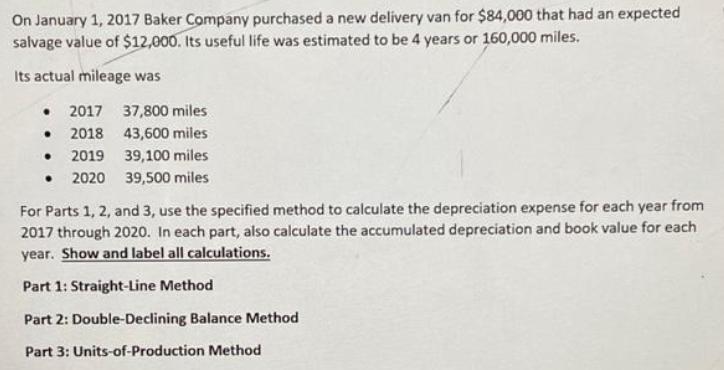

On January 1, 2017 Baker Company purchased a new delivery van for $84,000 that had an expected salvage value of $12,000. Its useful life was estimated to be 4 years or 160,000 miles. Its actual mileage was 2017 37,800 miles 2018 43,600 miles 2019 39,100 miles 2020 39,500 miles For Parts 1, 2, and 3, use the specified method to calculate the depreciation expense for each year from 2017 through 2020. In each part, also calculate the accumulated depreciation and book value for each year. Show and label all calculations. Part 1: Straight-Line Method Part 2: Double-Declining Balance Method Part 3: Units-of-Production Method

Step by Step Solution

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Explanation Part 1 Straight line depreciation Cost Salvage value Useful life 84000 120004 18000 per ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Reporting and Analysis

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer

7th edition

1259722651, 978-1259722653

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App