Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2017, Kandy Kmatz had unused RRSP deduction room of $16,900. In addition, because she was unemployed in the two previous years,

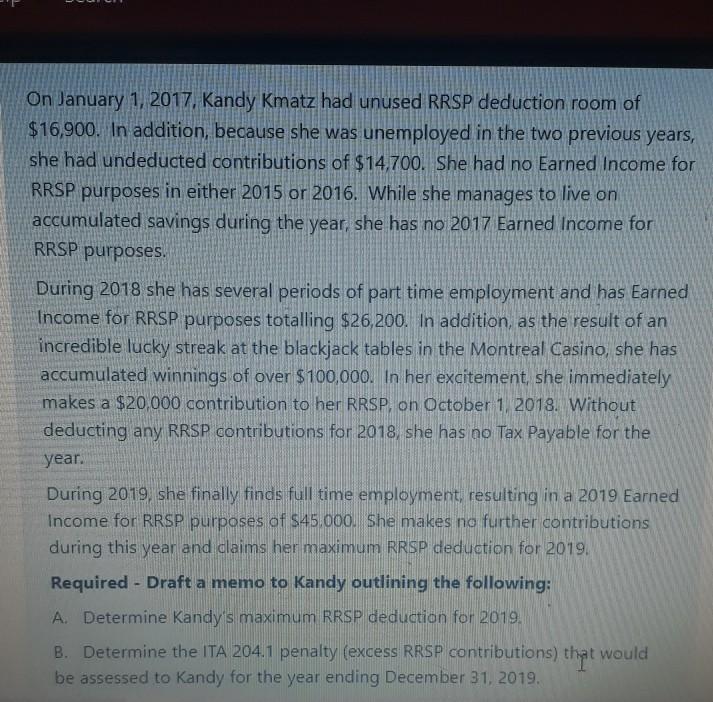

On January 1, 2017, Kandy Kmatz had unused RRSP deduction room of $16,900. In addition, because she was unemployed in the two previous years, she had undeducted contributions of $14,700. She had no Earned Income for RRSP purposes in either 2015 or 2016. While she manages to live on accumulated savings during the year, she has no 2017 Earned Income for RRSP purposes. During 2018 she has several periods of part time employment and has Earned Income for RRSP purposes totalling $26,200. In addition, as the result of an incredible lucky streak at the blackjack tables in the Montreal Casino, she has accumulated winnings of over $100,000. In her excitement, she immediately makes a $20,000 contribution to her RRSP, on October 1, 2018. Without deducting any RRSP contributions for 2018, she has no Tax Payable for the year. During 2019, she finally finds full time employment, resulting in a 2019 Earned Income for RRSP purposes of $45.000. She makes no further contributions during this year and claims her maximum RRSP deduction for 2019. Required - Draft a memo to Kandy outlining the following: A. Determine Kandy's maximum RRSP deduction for 2019. B. Determine the ITA 204.1 penalty (excess RRSP contributions) that would be assessed to Kandy for the year ending December 31, 2019.

Step by Step Solution

★★★★★

3.53 Rating (173 Votes )

There are 3 Steps involved in it

Step: 1

A Deter mine K andy s maximum RR SP deduction for 2019 ANS WER K andy s maximum RR SP deduction for 2019 is 9 000 This is because she has unused RR SP ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started