Question

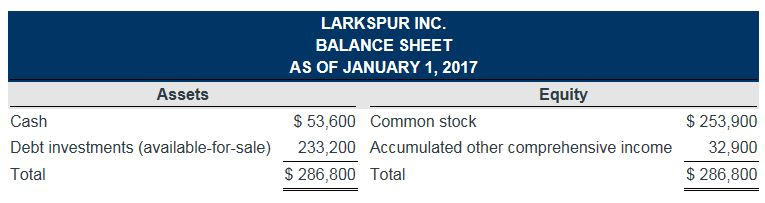

On January 1, 2017, Larkspur Inc. had the following balance sheet. The accumulated other comprehensive income related to unrealized holding gains on available-for-sale debt securities.

On January 1, 2017, Larkspur Inc. had the following balance sheet.

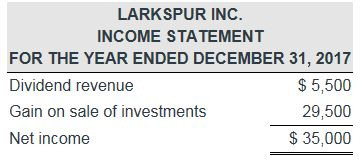

The accumulated other comprehensive income related to unrealized holding gains on available-for-sale debt securities. The fair value of Larkspur Inc.s available-for-sale debt securities at December 31, 2017, was $ 173,800; its cost was $ 132,200. No securities were purchased during the year. Larkspur Inc.s income statement for 2017 was as follows. (Ignore income taxes.)

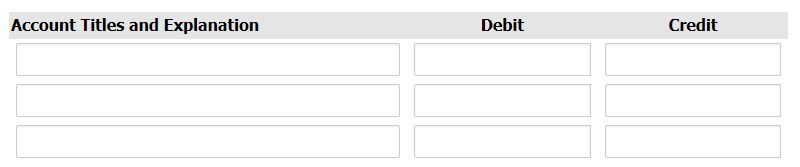

Prepare the journal entry to record the sale of the available-for-sale debt securities in 2017. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)

Prepare the journal entry to record the Unrealized Holding Gain or Loss for 2017. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)

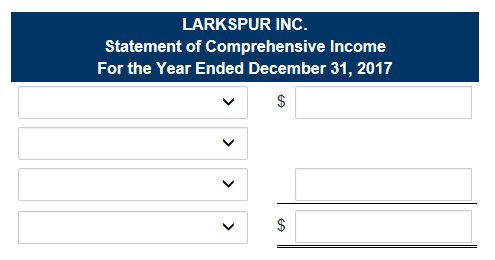

Prepare a statement of comprehensive income for 2017.

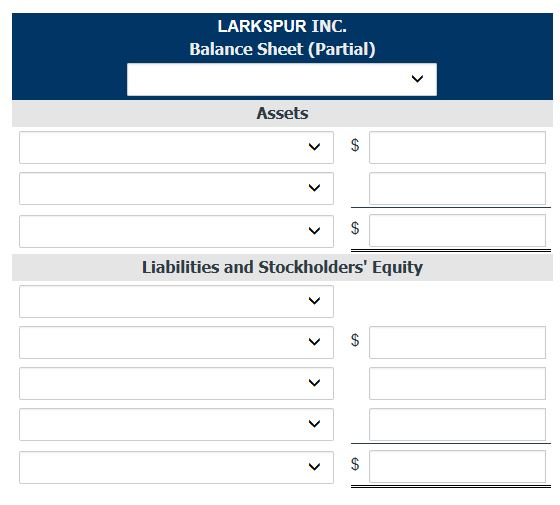

Prepare a balance sheet as of December 31, 2017.

List of Accounts

- Accumulated Other Comprehensive Loss

- Allowance for Loss on Debt Investment

- Bonds Payable

- Cash

- Call Option

- Common Stock

- Cost of Goods Sold

- Debt Investments

- Dividend Revenue

- Dividend Receivable

- Equity Investments

- Fair Value Adjustment

- Futures Contract

- Gain on Sale of Investments

- Gain on Settlement of Call Option

- Gain on Settlement of Put Option

- Interest Expense

- Interest Receivable

- Interest Revenue

- Inventory

- Investment Income

- Loss on Impairment

- Loss on Sale of Investments

- Loss on Settlement of Call Option

- Loss on Settlement of Put Option

- No Entry

- Notes Payable

- Paid-in Capital in Excess of Par - Common Stock

- Put Option

- Recovery of Loss from Impairment

- Retained Earnings

- Sales Revenue

- Swap Contract

- Unrealized Holding Gain or Loss - Equity

- Unrealized Holding Gain or Loss - Income

*PLEASE SHOW WORK*

LARKSPUR INC. BALANCE SHEET AS OF JANUARY 1, 2017 Assets Equity $53,600 Common stock Cash Debt investments (available-for-sale) Total $ 253,900 233,200 Accumulated other comprehensive income 32,900 $ 286,800 $ 286,800 Total LARKSPUR INC. INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31, 2017 Dividend revenue Gain on sale of investments Net income $5,500 29,500 $ 35,000 Account Titles and Explanation Debit Credit Account Titles and Explanation Debit Credit LARKSPUR INC. Statement of Comprehensive Income For the Year Ended December 31, 2017 LARKSPUR INC Balance Sheet (Partial) Assets Liabilities and Stockholders' Equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started