Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2017, the Hardin Company budget Committee has reached agreement on the following data for the six months ending June 30, 2017. Sales

On January 1, 2017, the Hardin Company budget Committee has reached agreement on the following data for the six months ending June 30, 2017.

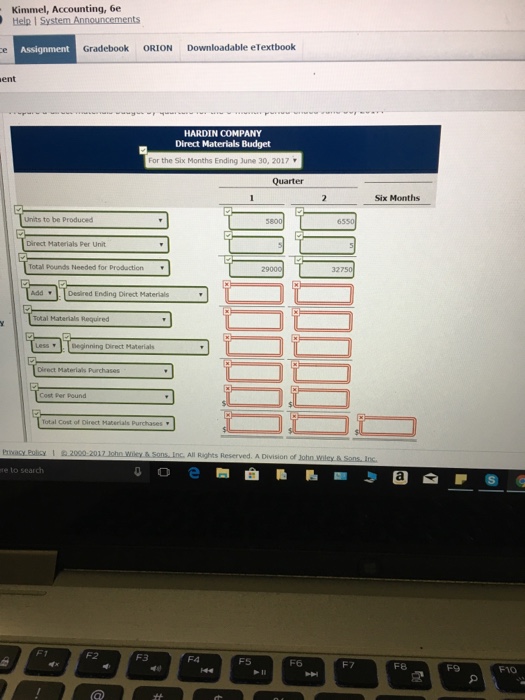

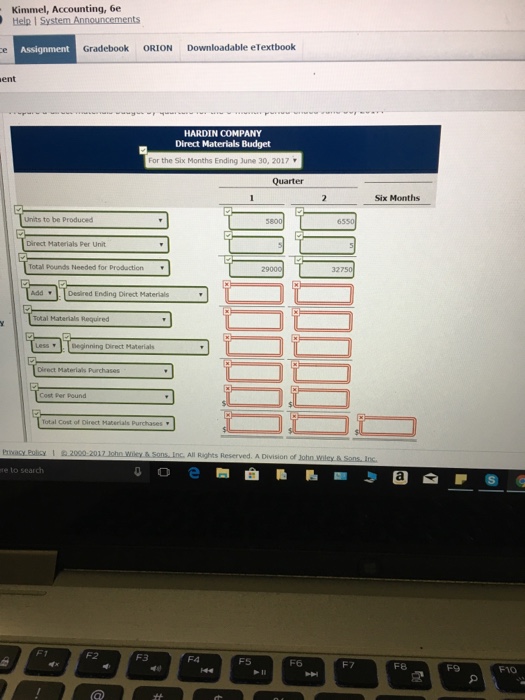

Kimmel, Accounting, 6e Gradebook ORION Downloadable eTextbook ent HARDIN COMPANY Direct Materials Budget For the Six Months Ending June 30, 2017 Quarter Six Months Units to be Produced Direct Materials Per Unit Total Pounds Needed for Production ddDesired Ending Direct MM Required LessBeginning Direct Materials otoriet ASon,Inc. All Rights Reserved. A Division of John wilcy & SonsInc re to search oe F1 F2 F3 F4 FS F6 F7 F8 F9 F10 Sales units: first-quarter 5600, second-quarter 6400, third-quarter 7000

Ending raw material inventory: 40% of the next quarters production requirements

Ending finished goods inventory: 25% of the next quarters expected sales units

Third-quarter production: 7440

The ending wrong materials and finished goods inventory at December 31, 2016, follow the same percentage relationships to production and sales that occur in 2017. 5 pounds of raw materials are required to make each unit of finished goods. Ron materials purchased are expected to cost four dollars per pound.

Prepare a direct materials budget by quarters for the six-month period ended June 30, 2017

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started