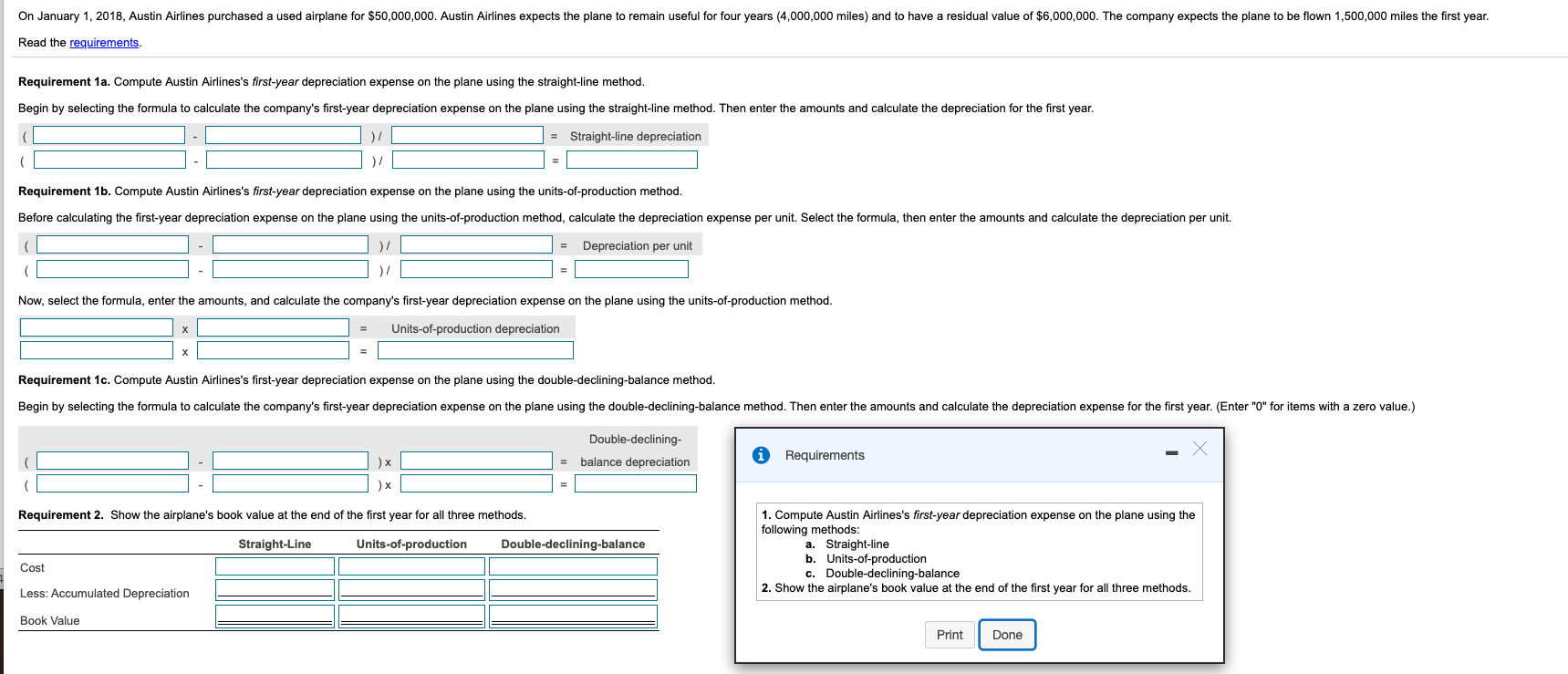

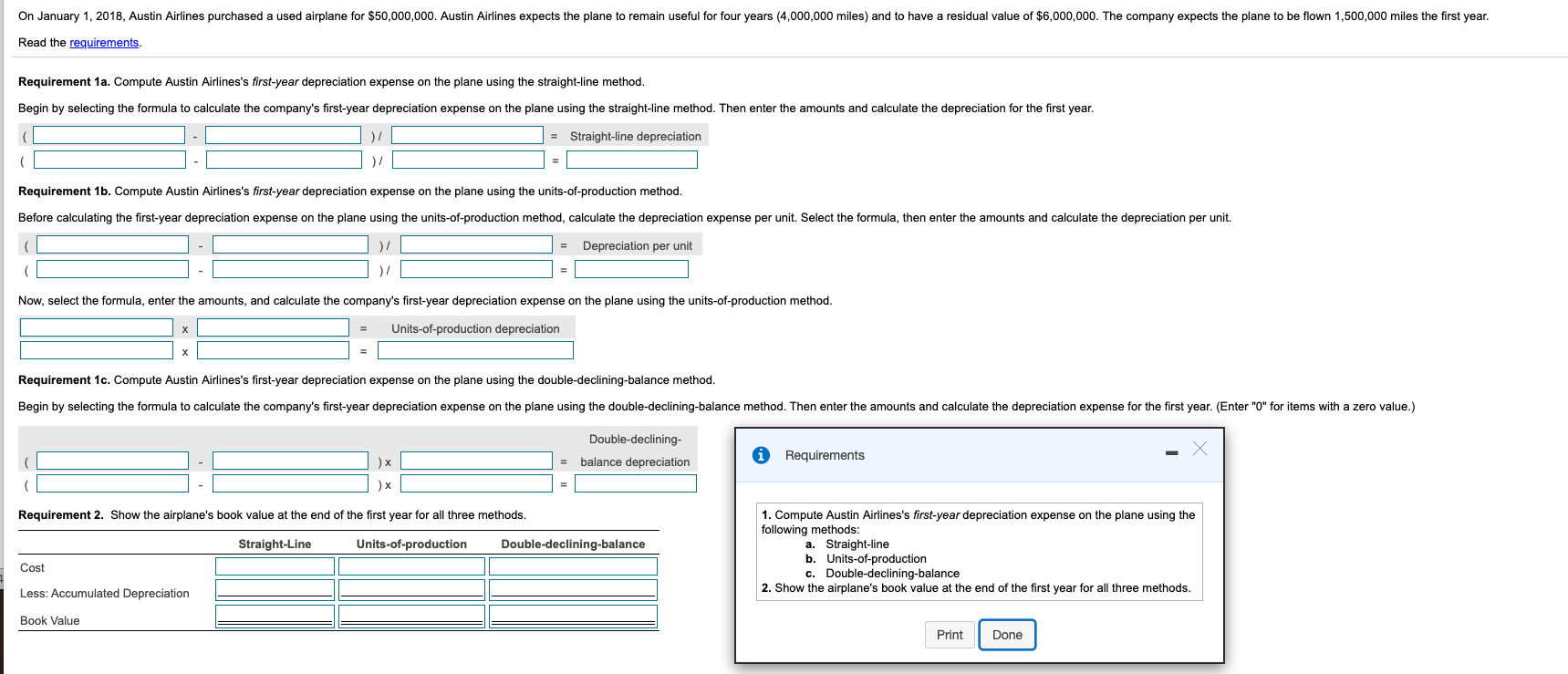

On January 1, 2018, Austin Airlines purchased a used airplane for $50,000,000. Austin Airlines expects the plane to remain useful for four years (4,000,000 miles) and to have a residual value of $6,000,000. The company expects the plane to be flown 1,500,000 miles the first year. Read the requirements. Requirement 1a. Compute Austin Airlines's first-year depreciation expense on the plane using the straight-line method. Begin by selecting the formula to calculate the company's first-year depreciation expense on the plane using the straight-line method. Then enter the amounts and calculate the depreciation for the first year. 1) = Straight-line depreciation Requirement 1b. Compute Austin Airlines's first-year depreciation expense on the plane using the units-of-production method. Before calculating the first-year depreciation expense on the plane using the units-of-production method, calculate the depreciation expense per unit. Select the formula, then enter the amounts and calculate the depreciation per unit. = Depreciation per unit Now, select the formula, enter the amounts, and calculate the company's first-year depreciation expense on the plane using the units-of-production method. = Units-of-production depreciation Requirement 1c. Compute Austin Airlines's first-year depreciation expense on the plane using the double-declining-balance method. Begin by selecting the formula to calculate the company's first-year depreciation expense on the plane using the double-declining-balance method. Then enter the amounts and calculate the depreciation expense for the first year. (Enter "O" for items with Double-declining- = balance depreciation Requirements J Requirement 2. Show the airplane's book value at the end of the first year for all three methods. Straight-Line Units-of-production Double-declining-balance 1. Compute Austin Airlines's first-year depreciation expense on the plane using the following methods: a. Straight-line b. Units-of-production c. Double-declining-balance 2. Show the airplane's book value at the end of the first year for all three methods. Cost Less: Accumulated Depreciation Book Value Print Done