Question

On January 1, 2018 Calloway Corporation acquired 80% of the outstanding voting stock of Murray Co.in exchange for $3,600,000 cash. At acquisition, Murray had a

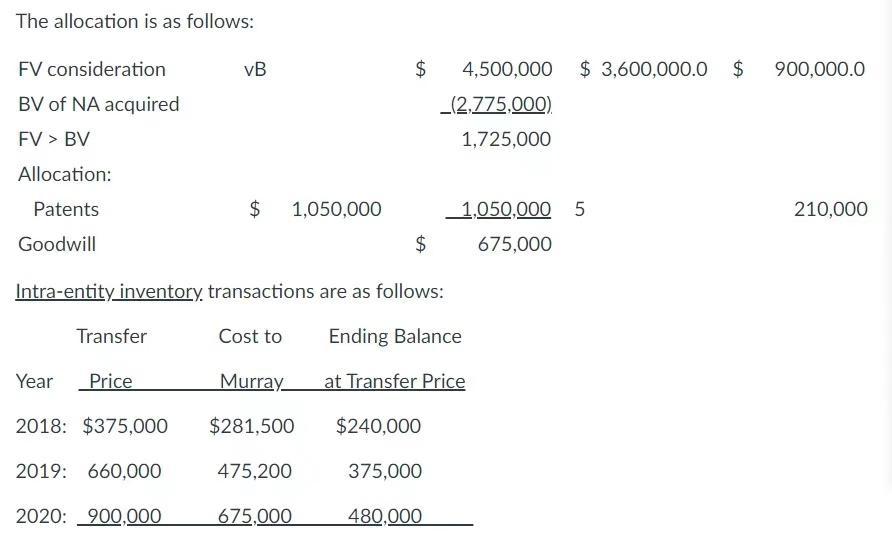

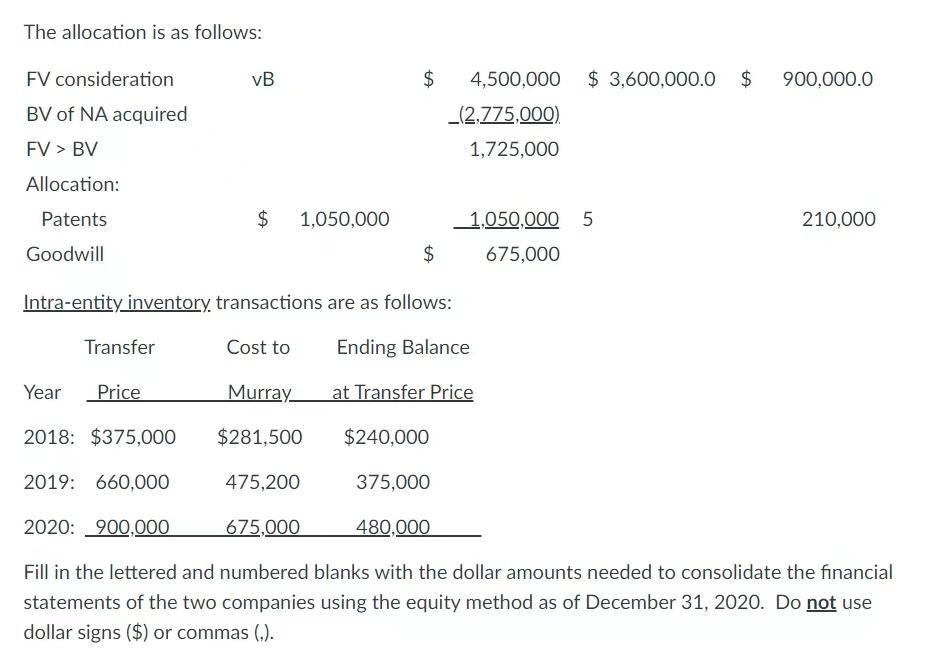

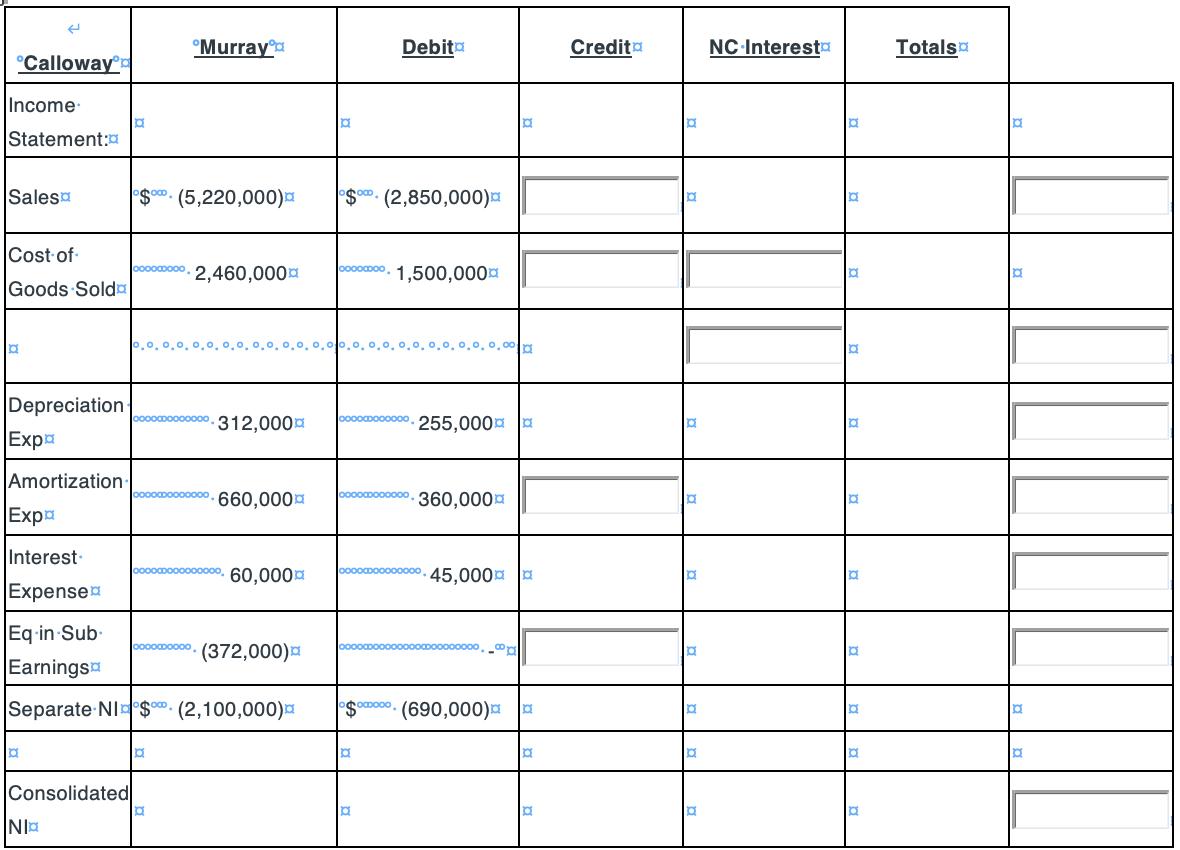

On January 1, 2018 Calloway Corporation acquired 80% of the outstanding voting stock of Murray Co.in exchange for $3,600,000 cash. At acquisition, Murray had a total book value of $2,775,000 and fair value of $4,500,000.With the exception of the patent account. which was undervalued by $1,050,000 the assets and liabilities approximated their acquisition-date fair values. At that time the patent had a remaining life of 5 years. Any remaining excess fair value is attributed to goodwill. Murray regularly sells inventory to Calloway.

The allocation is as follows: FV consideration BV of NA acquired FV > BV Allocation: Patents Goodwill Transfer vB $ 1,050,000 2020: 900,000 Cost to Year Price Murray 2018: $375,000 $281,500 2019: 660,000 $ Intra-entity inventory transactions are as follows: Ending Balance at Transfer Price $240,000 375,000 480,000 475,200 LA 675,000 $ 4,500,000 _(2,775,000) 1,725,000 $3,600,000.0 $ 900,000.0 1,050,000 5 675,000 210,000

Step by Step Solution

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To prepare the consolidated income statement we need to combine the financial information of Calloway Corporation and its subsidiary Murray Co First w...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started