Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2018 Megamart Ltd had a credit balance on its deferred tax account of $3,000,000 all in respect of the difference between

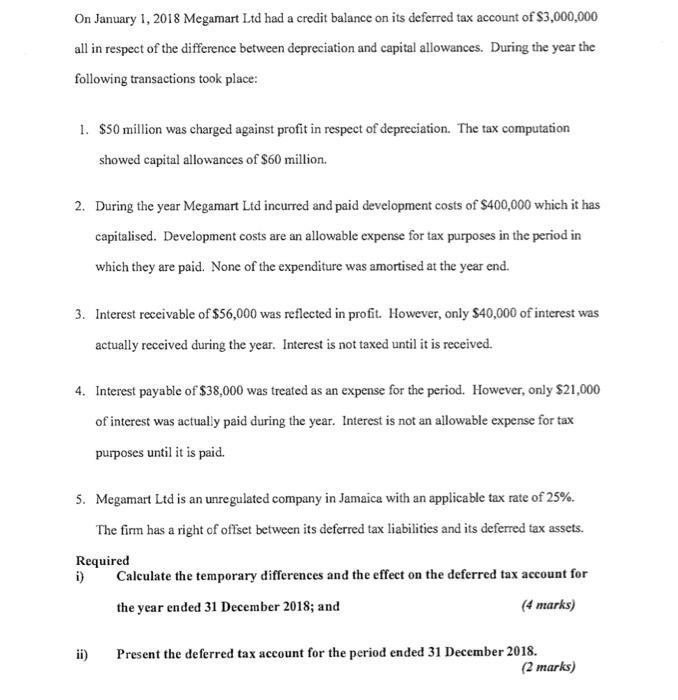

On January 1, 2018 Megamart Ltd had a credit balance on its deferred tax account of $3,000,000 all in respect of the difference between depreciation and capital allowances. During the year the following transactions took place: 1. $50 million was charged against profit in respect of depreciation. The tax computation showed capital allowances of $60 million. 2. During the year Megamart Ltd incurred and paid development costs of $400,000 which it has capitalised. Development costs are an allowable expense for tax purposes in the period in which they are paid. None of the expenditure was amortised at the year end. 3. Interest receivable of $56,000 was reflected in profit. However, only $40,000 of interest was actually received during the year. Interest is not taxed until it is received. 4. Interest payable of $38,000 was treated as an expense for the period. However, only $21,000 of interest was actually paid during the year. Interest is not an allowable expense for tax purposes until it is paid. 5. Megamart Ltd is an unregulated company in Jamaica with an applicable tax rate of 25%. The firm has a right of offset between its deferred tax liabilities and its deferred tax assets. Required i) Calculate the temporary differences and the effect on the deferred tax account for the year ended 31 December 2018; and (4 marks) ii) Present the deferred tax account for the period ended 31 December 2018. (2 marks)

Step by Step Solution

★★★★★

3.52 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Deferred Taxes Deferred taxes are the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started