Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2018, P Company purchased 6,000 shares of the 7,500 outstanding shares of S Company by paying P700,000. On that date, S

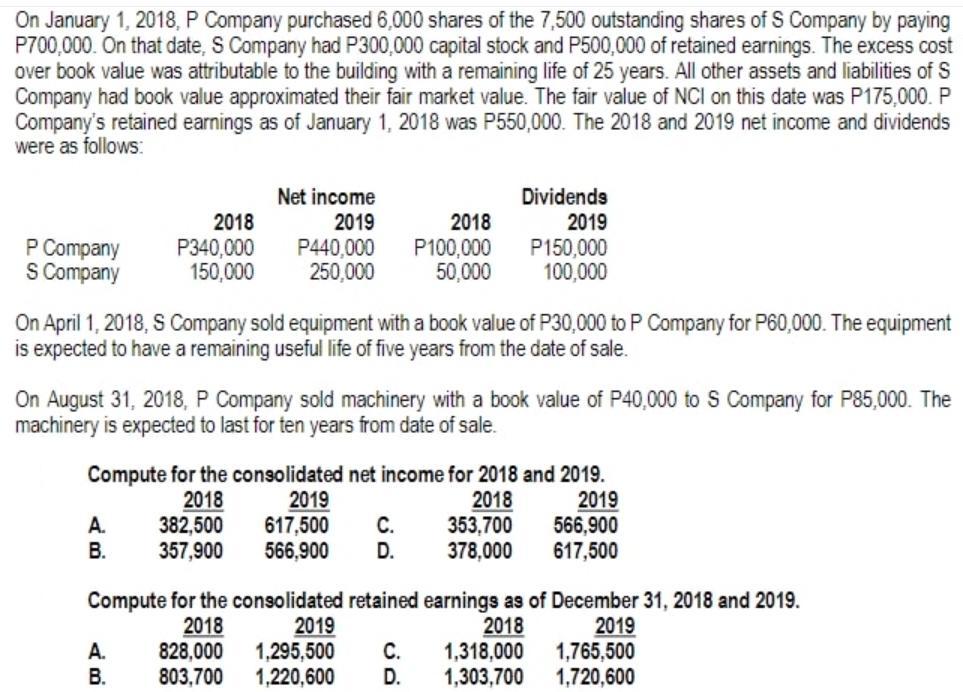

On January 1, 2018, P Company purchased 6,000 shares of the 7,500 outstanding shares of S Company by paying P700,000. On that date, S Company had P300,000 capital stock and P500,000 of retained earnings. The excess cost over book value was attributable to the building with a remaining life of 25 years. All other assets and liabilities of S Company had book value approximated their fair market value. The fair value of NCI on this date was P175,000. P Company's retained earnings as of January 1, 2018 was P550,000. The 2018 and 2019 net income and dividends were as follows: P Company S Company 2018 P340,000 150,000 A. B. Net income 2019 On April 1, 2018, S Company sold equipment with a book value of P30,000 to P Company for P60,000. The equipment is expected to have a remaining useful life of five years from the date of sale. A. B. P440,000 250,000 On August 31, 2018, P Company sold machinery with a book value of P40,000 to S Company for P85,000. The machinery is expected to last for ten years from date of sale. 382,500 357,900 Compute for the consolidated net income for 2018 and 2019. 2018 2018 2019 566,900 617,500 2018 P100,000 50,000 828,000 803,700 Dividends 2019 P150,000 100,000 2019 617,500 C. 566,900 D. 353,700 378,000 Compute for the consolidated retained earnings as of December 31, 2018 and 2019. 2018 2018 2019 2019 1,295,500 C. 1,318,000 1,220,600 D. 1,303,700 1,765,500 1,720,600

Step by Step Solution

★★★★★

3.68 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started