Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2018, Poplar Fabricators Corporation agreed to grant its employees two weeks' vacation each year, with the stipulation that vacations earned each

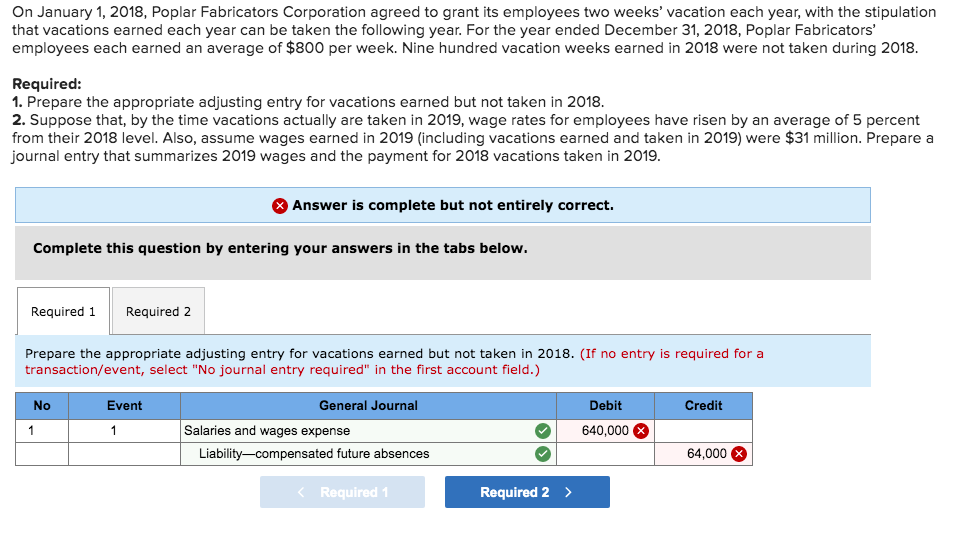

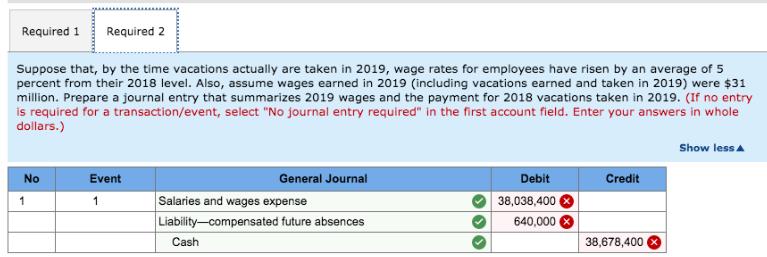

On January 1, 2018, Poplar Fabricators Corporation agreed to grant its employees two weeks' vacation each year, with the stipulation that vacations earned each year can be taken the following year. For the year ended December 31, 2018, Poplar Fabricators' employees each earned an average of $800 per week. Nine hundred vacation weeks earned in 2018 were not taken during 2018. Required: 1. Prepare the appropriate adjusting entry for vacations earned but not taken in 2018. 2. Suppose that, by the time vacations actually are taken in 2019, wage rates for employees have risen by an average of 5 percent from their 2018 level. Also, assume wages earned in 2019 (including vacations earned and taken in 2019) were $31 million. Prepare a journal entry that summarizes 2019 wages and the payment for 2018 vacations taken in 2019. O Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the appropriate adjusting entry for vacations earned but not taken in 2018. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) No Event General Journal Debit Credit 1 1 Salaries and wages expense 640,000 X Liability-compensated future absences 64,000 < Required 1 Required 2 > Required 1 Required 2 Suppose that, by the time vacations actually are taken in 2019, wage rates for employees have risen by an average of 5 percent from their 2018 level. Also, assume wages earned in 2019 (including vacations earned and taken in 2019) were $31 million. Prepare a journal entry that summarizes 2019 wages and the payment for 2018 vacations taken in 2019. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in whole dollars.) Show lessa No Event General Journal Debit Credit 1 1 Salaries and wages expense 38,038,400 Liability-compensated future absences 640,000 Cash 38,678,400

Step by Step Solution

★★★★★

3.54 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

journal entries event Particulars Debit Credit 1 Salary expenses 800 week800 64...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started