Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2018, Sicamous Company had 200,000 outstanding common shares and 100,000 outstanding preferred shares. The preferred shares had a stated value of

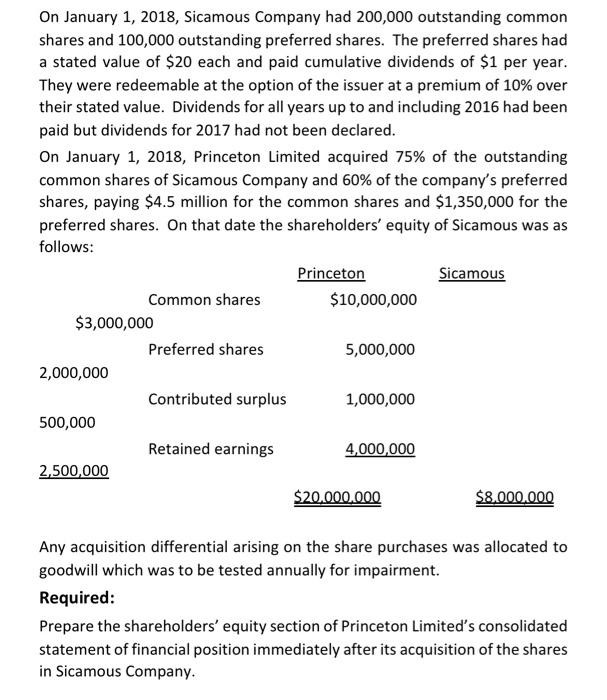

On January 1, 2018, Sicamous Company had 200,000 outstanding common shares and 100,000 outstanding preferred shares. The preferred shares had a stated value of $20 each and paid cumulative dividends of $1 per year. They were redeemable at the option of the issuer at a premium of 10% over their stated value. Dividends for all years up to and including 2016 had been paid but dividends for 2017 had not been declared. On January 1, 2018, Princeton Limited acquired 75% of the outstanding common shares of Sicamous Company and 60% of the company's preferred shares, paying $4.5 million for the common shares and $1,350,000 for the preferred shares. On that date the shareholders' equity of Sicamous was as follows: $3,000,000 2,000,000 500,000 Common shares 2,500,000 Preferred shares Contributed surplus Retained earnings Princeton $10,000,000 5,000,000 1,000,000 4,000,000 $20,000,000 Sicamous $8.000.000 Any acquisition differential arising on the share purchases was allocated to goodwill which was to be tested annually for impairment. Required: Prepare the shareholders' equity section of Princeton Limited's consolidated statement of financial position immediately after its acquisition of the shares in Sicamous Company.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started