Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2018, Sledge had common stock of $360,000 and retained earnings of $500,000. During that year, Sledge reported sales of $370,000, cost

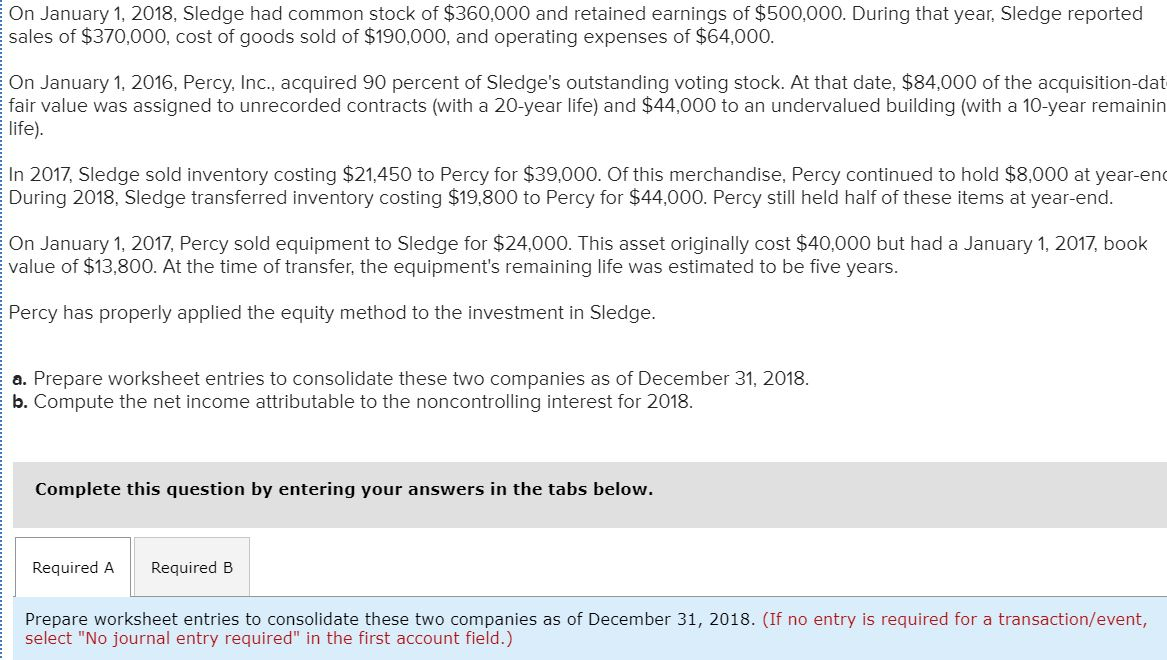

On January 1, 2018, Sledge had common stock of $360,000 and retained earnings of $500,000. During that year, Sledge reported sales of $370,000, cost of goods sold of $190,000, and operating expenses of $64,000. On January 1, 2016, Percy, Inc., acquired 90 percent of Sledge's outstanding voting stock. At that date, $84,000 of the acquisition-dat fair value was assigned to unrecorded contracts (with a 20-year life) and $44,000 to an undervalued building (with a 10-year remainin life). In 2017, Sledge sold inventory costing $21,450 to Percy for $39,000. Of this merchandise, Percy continued to hold $8,000 at year-end During 2018, Sledge transferred inventory costing $19,800 to Percy for $44,000. Percy still held half of these items at year-end. On January 1, 2017, Percy sold equipment to Sledge for $24,000. This asset originally cost $40,000 but had a January 1, 2017, book value of $13,800. At the time of transfer, the equipment's remaining life was estimated to be five years. Percy has properly applied the equity method to the investment in Sledge. a. Prepare worksheet entries to consolidate these two companies as of December 31, 2018. b. Compute the net income attributable to the noncontrolling interest for 2018. Complete this question by entering your answers in the tabs below. Required A Required B Prepare worksheet entries to consolidate these two companies as of December 31, 2018. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Elimination of Sledges ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started