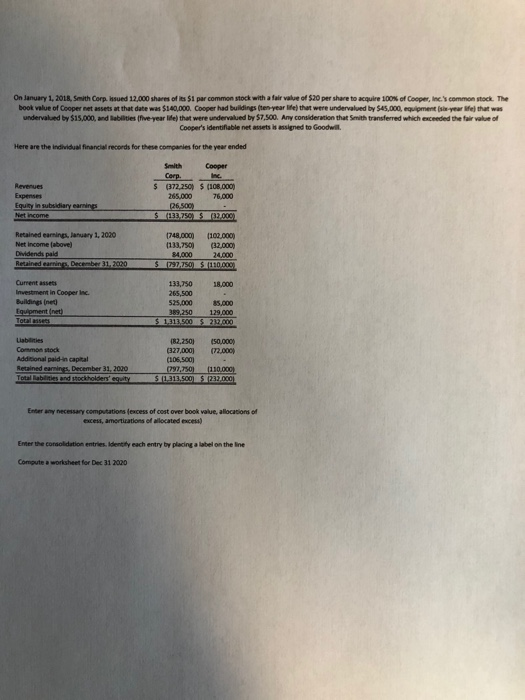

On January 1, 2018. Smith Corp. Issued 12,000 shares of its $1 par common stock with a fair value of $20 per share to acquire 100% of Cooper, Inc.'s common stock. The book value of Cooper net assets at that date was $140,000. Cooper had buildings (ten-year life that were undervalued by S45,000, equipment (she-year ife that was undervalued by $15.000, and abilities (five-year life that were undervalued by S7.500. Any consideration that Smith transferred which exceeded the fair value of Cooper's identifiable net assets is assigned to Goodwill Here are the individual financial records for these companies for the year ended Revenues Expenses Equity in subsidiary earnings het income Smith Cooper Corp Inc. $ (372,250) $ (108,000) 265,000 76,000 26,500 $ 133,75025 (02.009 Retained earnings, January 1, 2020 Net Income (above) Dividends pald Retained earnings. December 31, 2020 1748,000) [102.0001 (133,7501 (32.000 84,000 24.000 $ 1797 75015 (110.000 Current assets Investment in Cooper inc. Buildings ined Equipment.net Total 139,750 18.000 265,500 525,000 389,250 129.000 $ 1313,500 213.000 Liabilities Common ock Addicional paid in capital Retained earnings. December 31, 2020 Total abilities and stockholders' city (82,250) (50,000 (327,000) (72.000 (106,500) (797,750) [110,000 51313.50051232 DO Enter any necessary computations (excess of cost over book value, allocations of excess, amortizations of located excess) Emer the consolidation entries. Identity each entry by placing a label on the line Computea worksheet for Dec 31 2020 On January 1, 2018. Smith Corp. Issued 12,000 shares of its $1 par common stock with a fair value of $20 per share to acquire 100% of Cooper, Inc.'s common stock. The book value of Cooper net assets at that date was $140,000. Cooper had buildings (ten-year life that were undervalued by S45,000, equipment (she-year ife that was undervalued by $15.000, and abilities (five-year life that were undervalued by S7.500. Any consideration that Smith transferred which exceeded the fair value of Cooper's identifiable net assets is assigned to Goodwill Here are the individual financial records for these companies for the year ended Revenues Expenses Equity in subsidiary earnings het income Smith Cooper Corp Inc. $ (372,250) $ (108,000) 265,000 76,000 26,500 $ 133,75025 (02.009 Retained earnings, January 1, 2020 Net Income (above) Dividends pald Retained earnings. December 31, 2020 1748,000) [102.0001 (133,7501 (32.000 84,000 24.000 $ 1797 75015 (110.000 Current assets Investment in Cooper inc. Buildings ined Equipment.net Total 139,750 18.000 265,500 525,000 389,250 129.000 $ 1313,500 213.000 Liabilities Common ock Addicional paid in capital Retained earnings. December 31, 2020 Total abilities and stockholders' city (82,250) (50,000 (327,000) (72.000 (106,500) (797,750) [110,000 51313.50051232 DO Enter any necessary computations (excess of cost over book value, allocations of excess, amortizations of located excess) Emer the consolidation entries. Identity each entry by placing a label on the line Computea worksheet for Dec 31 2020