Thirsty Limited's business involves the bottling and distribution of a wide variety of carbonated soft drinks. Some drinks are developed internally, whilst other brands

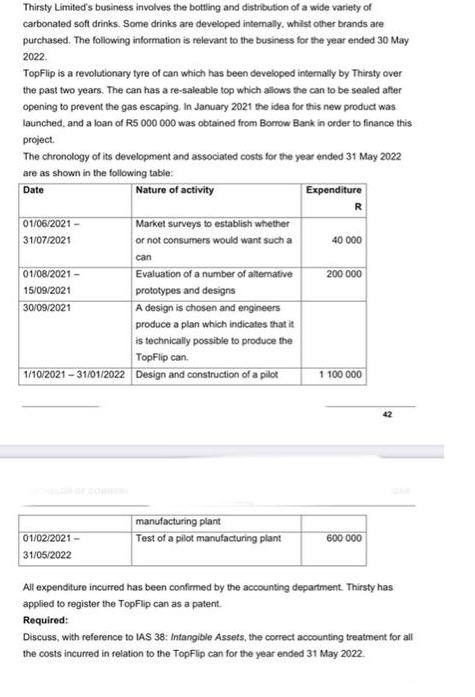

Thirsty Limited's business involves the bottling and distribution of a wide variety of carbonated soft drinks. Some drinks are developed internally, whilst other brands are purchased. The following information is relevant to the business for the year ended 30 May 2022. TopFlip is a revolutionary tyre of can which has been developed internally by Thirsty over the past two years. The can has a re-saleable top which allows the can to be sealed after opening to prevent the gas escaping. In January 2021 the idea for this new product was launched, and a loan of R5 000 000 was obtained from Borrow Bank in order to finance this project. The chronology of its development and associated costs for the year ended 31 May 2022 are as shown in the following table: Date Nature of activity 01/06/2021- 31/07/2021 01/08/2021- 15/09/2021 30/09/2021 Evaluation of a number of alternative prototypes and designs A design is chosen and engineers produce a plan which indicates that it is technically possible to produce the TopFlip can. 1/10/2021-31/01/2022 Design and construction of a pilot Market surveys to establish whether or not consumers would want such a can 01/02/2021- 31/05/2022 manufacturing plant Test of a pilot manufacturing plant Expenditure 40 000 200 000 1 100 000 600 000 All expenditure incurred has been confirmed by the accounting department. Thirsty has applied to register the TopFlip can as a patent. Required: Discuss, with reference to IAS 38: Intangible Assets, the correct accounting treatment for all the costs incurred in relation to the TopFlip can for the year ended 31 May 2022 Thirsty Limited's business involves the bottling and distribution of a wide variety of carbonated soft drinks. Some drinks are developed internally, whilst other brands are purchased. The following information is relevant to the business for the year ended 30 May 2022. TopFlip is a revolutionary tyre of can which has been developed internally by Thirsty over the past two years. The can has a re-saleable top which allows the can to be sealed after opening to prevent the gas escaping. In January 2021 the idea for this new product was launched, and a loan of R5 000 000 was obtained from Borrow Bank in order to finance this project. The chronology of its development and associated costs for the year ended 31 May 2022 are as shown in the following table: Date Nature of activity 01/06/2021- 31/07/2021 01/08/2021- 15/09/2021 30/09/2021 Evaluation of a number of alternative prototypes and designs A design is chosen and engineers produce a plan which indicates that it is technically possible to produce the TopFlip can. 1/10/2021-31/01/2022 Design and construction of a pilot Market surveys to establish whether or not consumers would want such a can 01/02/2021- 31/05/2022 manufacturing plant Test of a pilot manufacturing plant Expenditure 40 000 200 000 1 100 000 600 000 All expenditure incurred has been confirmed by the accounting department. Thirsty has applied to register the TopFlip can as a patent. Required: Discuss, with reference to IAS 38: Intangible Assets, the correct accounting treatment for all the costs incurred in relation to the TopFlip can for the year ended 31 May 2022

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Step 12 As Per IAS 38 All Research Expenses are Charged to Statement of Pro...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started