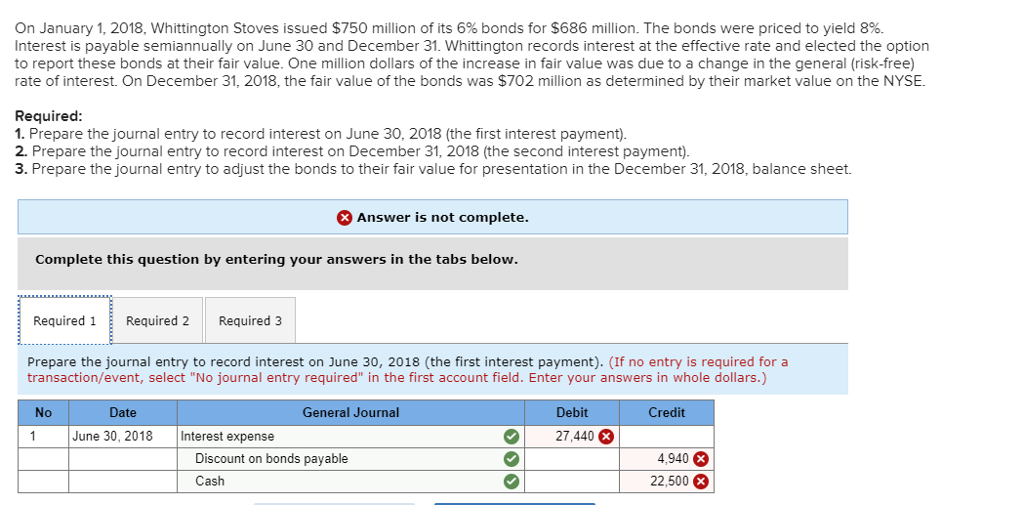

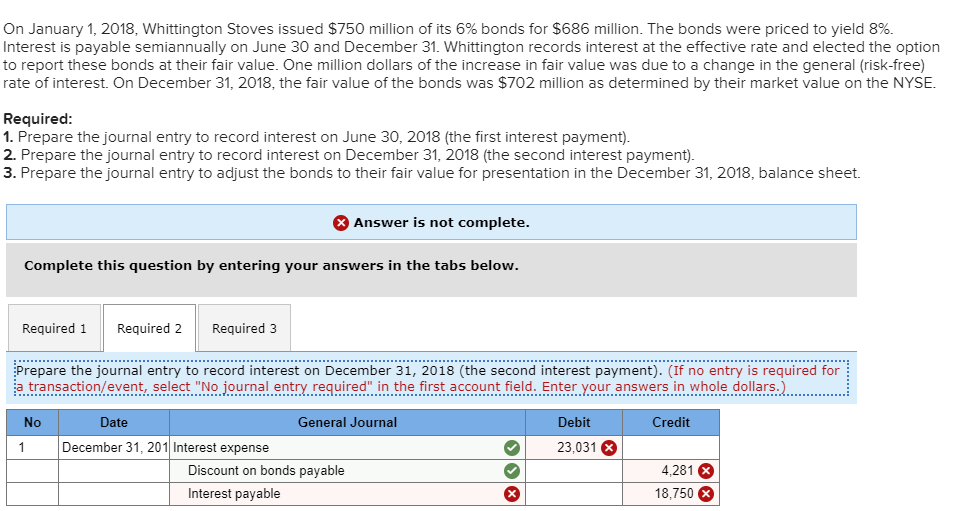

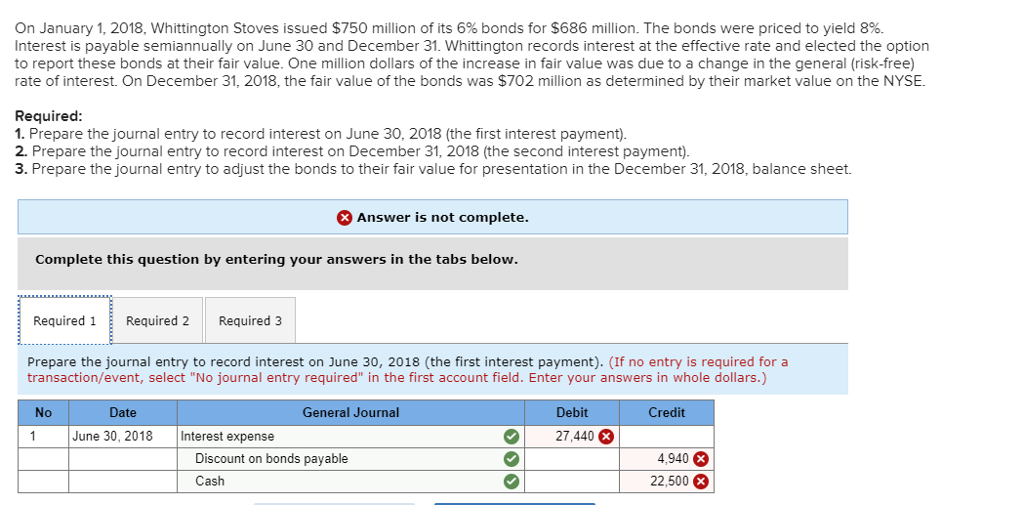

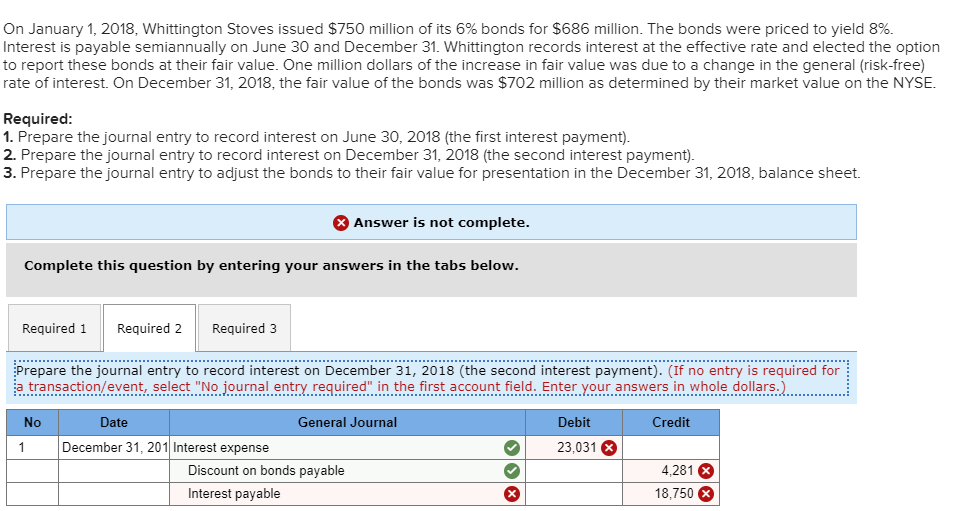

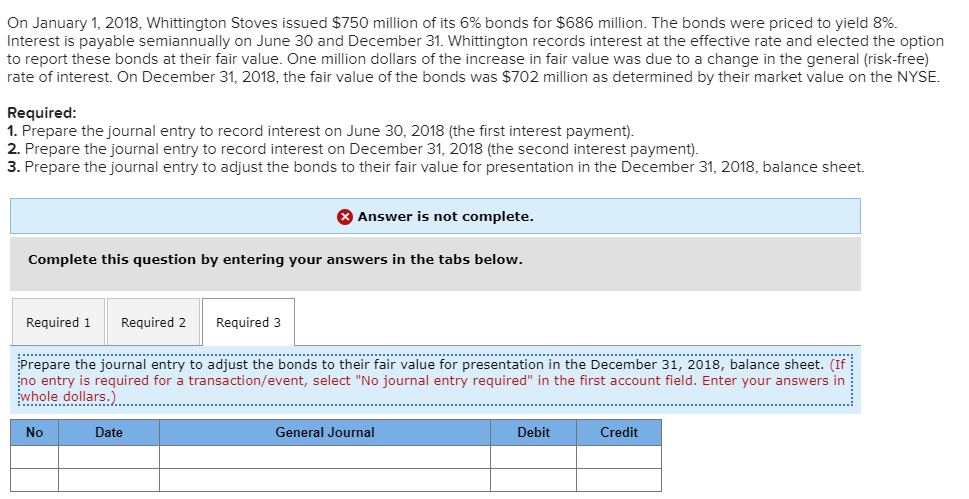

On January 1, 2018, whittington Stoves issued $750 million of its 6% bonds for $686 million. The bonds were priced to yield 8%. Interest is payable semiannually on June 30 and December 31. Whittington records interest at the effective rate and elected the option to report these bonds at their fair value. One million dollars of the increase in fair value was due to a change in the general (risk-free) rate of interest. On December 31, 2018, the fair value of the bonds was $702 million as determined by their market value on the NYSE. Required: 1. Prepare the journal entry to record interest on June 30, 2018 (the first interest payment) 2. Prepare the journal entry to record interest on December 31, 2018 (the second interest payment). 3. Prepare the journal entry to adjust the bonds to their fair value for presentation in the December 31, 2018, balance sheet Answer is not complete. Complete this question by entering your answers in the tabs below Required 1Required 2 Required 3 Prepare the journal entry to record interest on June 30, 2018 (the first interest payment). (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in whole dollars.) No Date General Journal Debit Credit June 30, 2018 Interest expense 27,440 Discount on bonds payable Cash 4,940 22,500 On January 1, 2018, whittington Stoves issued $750 million of its 6% bonds for $686 million. The bonds were priced to yield 8%. Interest is payable semiannually on June 30 and December 31. Whittington records interest at the effective rate and elected the option to report these bonds at their fair value. One million dollars of the increase in fair value was due to a change in the general (risk-free) rate of interest. On December 31, 2018, the fair value of the bonds was $702 million as determined by their market value on the NYSE Required 1. Prepare the journal entry to record interest on June 30, 2018 (the first interest payment) 2. Prepare the journal entry to record interest on December 31, 2018 (the second interest payment). 3. Prepare the journal entry to adjust the bonds to their fair value for presentation in the December 31, 2018, balance sheet. Answer is not complete Complete this question by entering your answers in the tabs below Required 1 Required 2 Required 3 Prepare the journal entry to record interest on December 31, 2018 (the second interest payment). (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in whole dollars.) Date General Journal Debit Credit December 31, 201 Interest expense 23,031 Discount on bonds payable Interest payable 4,281 18,750 On January 1, 2018, Whittington Stoves issued $750 million of its 6% bonds for $686 million. The bonds were priced to yield 8%. Interest is payable semiannually on June 30 and December 31. Whittington records interest at the effective rate and elected the option to report these bonds at their fair value. One million dollars of the increase in fair value was due to a change in the general (risk-free) rate of interest. On December 31, 2018, the fair value of the bonds was $702 million as determined by their market value on the NYSE. Required 1. Prepare the journal entry to record interest on June 30, 2018 (the first interest payment). 2. Prepare the journal entry to record interest on December 31, 2018 (the second interest payment) 3. Prepare the journal entry to adjust the bonds to their fair value for presentation in the December 31, 2018, balance sheet Answer is not complete Complete this question by entering your answers in the tabs below Required 1 Required 2 Required 3 Prepare the journal entry to adjust the bonds to their fair value for presentation in the December 31, 2018, balance sheet. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in whole dollars.) No Date General Journal Debit Credit